The leading behavioral investment mistake

By Thomas Oberlechner, Chief Science Officer, TheHintBox!,Inc,

a related company

Biography:

Thomas Oberlechner, Ph.D.

Dr. Oberlechner is Chief Scientist at TheHintBox!,Inc, a related company to Intellectus Partners. He is also founder and partner of FinPsy LLC, a San Francisco based behavioral consultancy. He helps decision-makers in finance and investment integrate state-of-the art

behavioral expertise into their decisions, products, and organizations.

Dr. Oberlechner is a leading expert on behavioral and psychological aspects of financial decisionmaking. While previously Chief Science Officer at iMatchative, he developed decision support systems for investors and hedge fund managers that add novel behavioral dimensions to the financial hedge fund data traditionally available. These systems provide investors and fund managers with deep

insight into behavioral preferences, styles, and goals.

In his academic career, he was a full university professor and Psychology Department Head at Webster University in Vienna. He has also researched and taught at Harvard University, MIT,University of Cologne, University of Vienna, and other leading research institutions. His

groundbreaking work on psychological dynamics in financial markets has led him into the trading floors of the world’s leading banks and other top-tier market participants. Results of his research have appeared in numerous academic and professional journals in both psychology and finance.

His published work includes the books The Psychology of the Foreign Exchange Market (Wiley) and award-winning The Psychology of Ethics in the Finance and Investment Industry (CFA Institute).

Dr. Oberlechner received his academic education at University of Vienna and Harvard. His credentials include a Ph.D. in Psychology, multiple Master degrees in Psychology, Consulting Psychology, and Law, and a Habilitation in Psychology, the highest academic qualification conferred by European universities. Over 20 years of work as a clinical psychologist, senior training therapist, and executive coach provide him with unparalleled knowledge of human behavior and motivation among financial decision makers.

The leading behavioral investment mistake.......

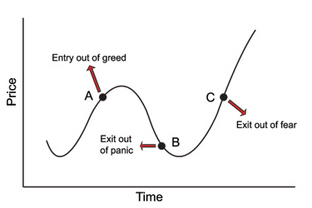

“Which behavioral mistake makes investors lose the most money?”, I was asked recently. It’s a great question, given the dozens of widespread decision-making biases and errors that financial psychologists and behavioral economists have identified over the years. And like so many good questions, it is a hard one, if not an impossible one, to answer. Like all human behavior, making an investment decision involves a multi-level, complex interplay of processes: the cognitive (how you think; for example, how you process facts and information about the markets), the affective (what emotions you experience; for example, the regret you feel about not having bought the stock that made your neighbor a fortune), and the perceptual (how you perceive the outside world; for example, to what specific events and possible consequences of the recent presidential elections you pay attention). Moreover, as investors, we don’t live in an isolated dark room that keeps us immune to the influence of others. Rather, we read the news, we talk to our friends, and we observe, in conscious and less-than-conscious ways, what others do in the markets and how they understand what is happening. To this list, add social factors like conformity and groupthink, then you discover what may lead people astray in their financial decision-making!

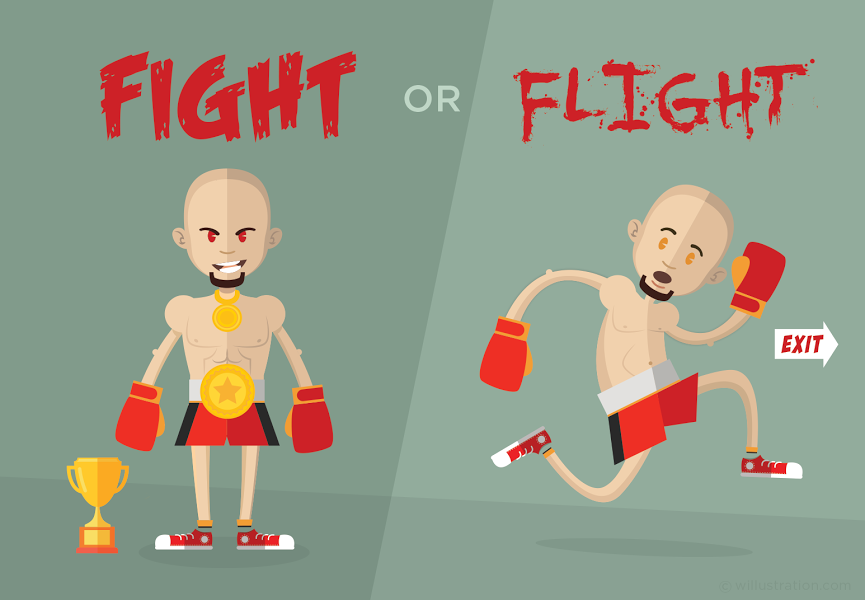

Next, consider that only very late in the course of evolution did humans come up with the concept of money and start acting as investors and financial decision makers. Compare this financial decision-making to how people deal with stress in modern life, and you realize that from an evolutionary perspective, we are not equipped to deal with either challenge optimally. For example, when we feel threatened by a sudden, unexpected stressor in the environment, our evolutionary response is to either flee from the stressor or to engage in an immediate fight. While this fight or flight reflex had survival value in the world of the hunter-gatherers (think of the sudden sight of an approaching tiger), in today’s world simply running away and hiding or attacking to destroy the source of stressors is usually not adequate (think of your financial advisor breaking the bad news of an unexpected investment loss). Similarly, our hard-wired, innate tendencies in financial and investment decision situations may also be limited.

So which one behavioral mistake, or tendency, makes investors lose the most money? Count overconfidence, the confirmation bias, loss aversion, regret avoidance, herding and conformity, hindsight, framing effects, self-serving attributions, such information-processing heuristics as availability, anchoring and representativeness, and the human tendency to perceive patterns in randomness among the most common. Many of these psychological processes and tendencies among investors are not independent of each other. I do not know if there is one single winner in terms of possible negative consequences on financial returns. However, I suspect that there is one particularly important contender for first price on the meta-level which determines our approach to these behavioral reactions and our underlying view of markets and people as investors. This one contender is the economic assumption that (at least some) people who process information and make decisions in an economic “rational” way are superhuman. If we unrealistically hold this assumption regarding ourselves, then this assumption keeps us from exploring the ways in which we can go wrong, for if one is rational, then there’s no reason to take a scientific interest in exploring unintended behavioral tendencies and counteracting them. Similarly, if we hold the rationality assumption regarding others who are widely considered experts, then we may overlook their own decision-making tendencies and their possibly skewed motivations in the opinions and in the advice they provide. Contrasting their seeming perfection to our own deficiencies can render us helpless and blindly dependent.

To counteract this danger, we should happily embrace the notion that in investing, as in all other areas of life, we are people and thus psychological; we are not machines, and we are not rational. Knowing who we are as investors and how we decide, being aware of our behavioral tendencies, preferences, strengths, and limitations, creates a better, more realistic starting point for leading financial lives that are meaningful and rewarding. From this perspective, the question then arises what kind of advice and decision-making support can best help us pursue our personal values and goals while ensuring that how we conduct our financial lives is both creative and successful. The newest financial technology allowing personalized advice that is based on artificial intelligence combined with behavioral systems that provide invaluable self-insight will allow us to take the next exciting steps in this venture.

Comments