If there is a word to recap past months in markets, then it is “chaos.” Recent tensions in Italy were a reminder Europe could break up at some point in the future. Investors responded by seeking “safe havens” like U.S. Treasuries and the Japanese Yen.

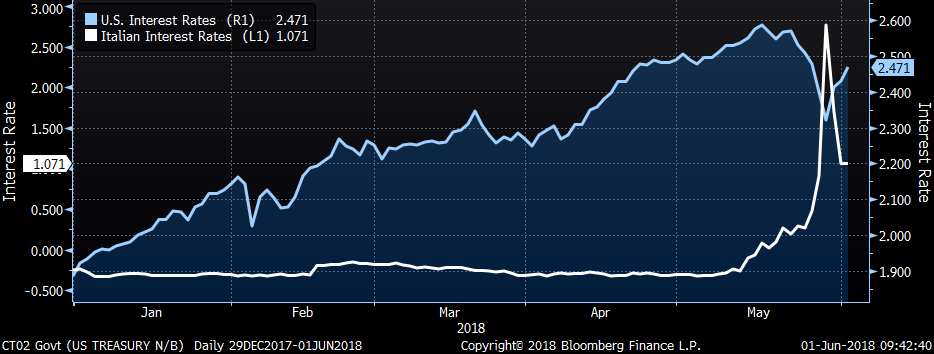

When uncertainty reached a climax in June, Italian interest rates spiked above those of the U.S. (see Figure 1). A situation like this can lead to a political resolve. Markets were for example discounting the Federal Reserve to hold off on interest rate increases if the crisis in Italy were to get out of control. On the other hand, after much last-minute wrangling, Italy managed to get a government together. That eased concerns only brief when the U.S. unexpectedly announced tariffs on steel imports from Canada, Mexico and Europe.

What these events describe is a market environment where economic data and policy headlines become correlated. A positive event, say a strong jobs report, is offset by a negative event, for example trade tariffs. For investors to navigating “chaos” means taking positions where there is absolute clarity about direction.

For example, despite global developments, the Federal Reserve is unlikely to stop hiking rates. The U.S. economy remains strong driven by the effects of tax cuts. If President Trump manages trade policy such that major industries must produce domestically, the economy could grow faster. That means short-term interest rate are likely to continue to rise. While at the same time, equities and high yield provide a positive return so far this year. Rising short term interest rate and equities have direction and that can benefit a portfolio in an environment of chaos and headlines.

Markets face several cross currents such as Italy, North Korea, trade negotiations, central bank tightening, the Brexit and U.S. mid-term elections. The likelihood of more volatility ahead is high even though the economy remains on a strengthening path. Investors betting on certain sectors like short term Treasuries, equities and high yield that have a high degree of certainty in terms of direction will fare well.

Figure 1: Italian and U.S. Interest Rates

Comments