Philanthropy - How and why we give?

The saying holds true for most people; “If you have much, give of your wealth; if you have little, give of your heart.” Nearly everyone wants to contribute to and make a difference in the world. For those who have been fortunate enough to accumulate any degree of wealth, some give it away because people ask them to, but the majority of people give because they care about other people & want to support causes to make an impact on the world.

In this post we will discuss some of the basic ways to start a giving & charitable program, while highlighting some of the advantages and disadvantages of each approach. In follow up posts, we will cover more of the technical aspects and some specialized asset-gifting opportunities. As mentioned previously, most people give to make an impact and to help other people, setting up giving plans in order to: support a cause that has effected people in our lives, reflect our values and belief systems through giving, feel like we are part of something bigger, enhance social connectivity and a sense of community, and simply to make us feel good.

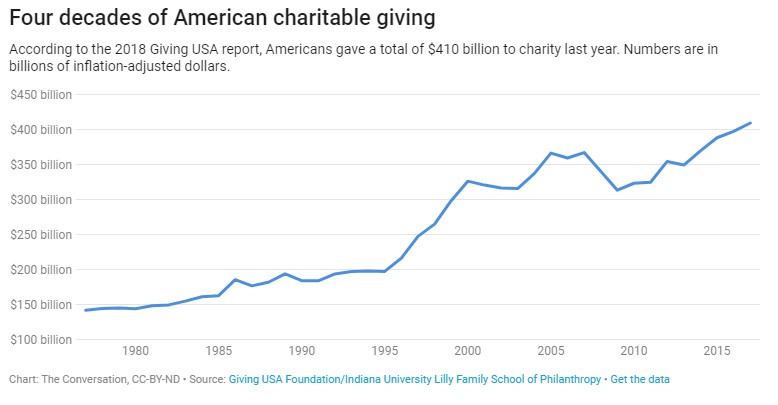

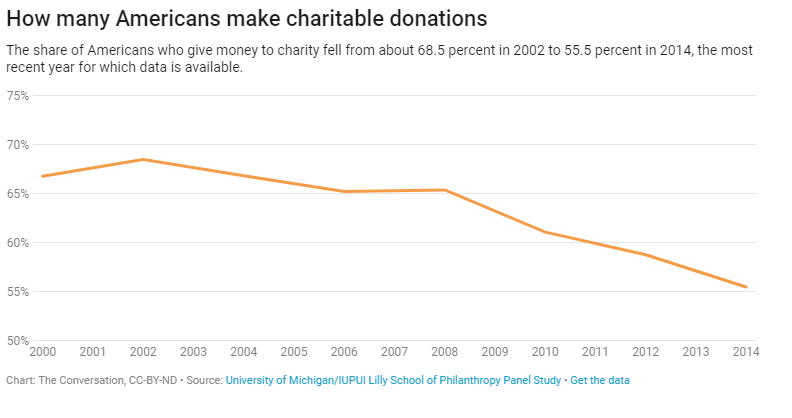

Sometimes there are specific catalysts that spur giving, which could come in the form of an opportunity to build a lasting legacy, or the need for tax deductions that can come along with giving. Everyone appreciates that there my be some tax benefits while doing good. As seen in Exhibit 1 below, the overall dollars that are being given away in the United States is growing at a very steady clip, reaching nearly $400 billion for the calendar year 2018. However, the overall trend is also showing that fewer people are choosing or able to give. The super-wealthy are certainly giving more over the past 15 years in particular. More than 190 billionaires from around the world have now signed the Warren Buffett and Bill & Melinda Gates’ “The Giving Pledge” (https://givingpledge.org/), promising to donate at least half of their fortunes to charity. So, it seems safe to assume that the source of giving is becoming more concentrated and is coming in the form of enormous pledges from the wealthiest Americans.

Exhibit 1 - Source: Giving USA Foundation / Indiana University Lily Family School of Philanthropy

Exhibit 2- Source: Giving USA Foundation / Indiana University Lily Family School of Philanthropy

So, we know that a lot of dollars are being given away in the United States, but how do people give? If you aren’t quite ready to sign up for “The Giving Pledge” mentioned earlier, there are still some easy ways to get started. The way that most people start giving is by writing checks to the causes that they care about, without having a specific plan regarding how much to give, when to give, or which causes to support. This could include supporting your family’s educational institutions, your religious affiliations, medical research associated with a specific illness or disease that has effected your loved ones, and social or humanitarian issues that you would like to support.

At some point, people typically want a little more structure and focus associated with their philanthropy and gifting.The main choices that people typically consider when setting up more advanced giving plans come in some form of the following: Donor Advised Funds (DAFs) , Charitable Remainder Trusts (CRTs) or a Private Foundation. There are pros and cons to each strategy, and we will lay out some the high-level aspects to consider below:

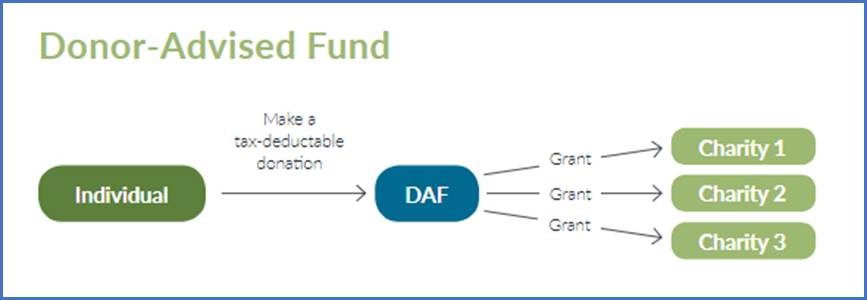

A Gift to a “Donor Advised Fund”

One of the simpler approaches would be to make a gift to an established Donor Advised Fund (DAF). A Donor Advised Fund is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. You can contribute a variety of assets to a public charity that sponsors a DAF, and you are generally eligible to take an immediate tax deduction. The deduction can be up to 60% for cash donations and 30% for appreciated asset donations. The funds can be invested for tax-free growth, and are available for you to recommend grants to any IRS-qualified public charity in a time frame that works best for you. DAFs can be a great choice for donors who want a simple, efficient solution that helps maximize their philanthropic efforts. While they do not offer the same grant-making flexibility as private foundations, DAFs are an effective solution that will meet the needs of many donors who do not wish to take on the extensive administration or grant-making due diligence involved in running a private foundation. The advantage of this approach is that it is relatively simple and it probably produces the greatest tax benefits for you. Your gift to the DAF is treated like a gift to a public charity. The unused portion of the deduction in any tax year can be carried forward up to five additional years. Thus this approach is likely to give you the largest tax benefit from your initial gift.

Benefits:

- Low minimums of $5,000 to establish a Donor Advised Fund or $250,000 for managed accounts

- Take an immediate tax deduction for your charitable contribution – up to 60% for Cash donations and 30% for appreciated assets

- Support the charities you care about right away or over time

- Ongoing contribution and subsequent grant recommendation process is pretty simple with a DAF

- Potentially grow your donation tax-free by recommending how the funds should be invested until a grant is made

- Streamline your recordkeeping and consolidate tax receipts, all in one centralized location

- Support charitable causes anonymously, if you wish

Considerations:

- While you choose where to make grant recommendations, the sponsoring charity has ultimate control over the grants

- A DAF cannot make distributions directly to individuals, but would be limited to making payments to public charities

Source: Fidelity Charitable: “Charitable Planning Guide”

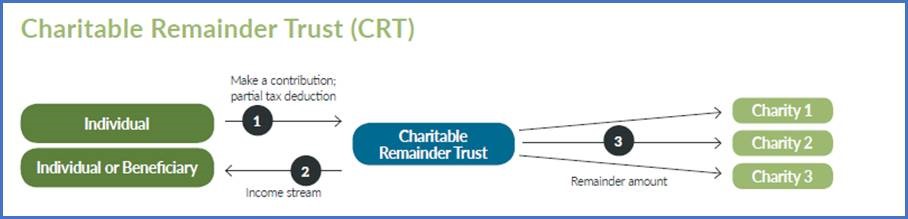

Charitable Remainder Trusts (CRT)

Some charitable solutions can support dual objectives of generating income while also pursuing philanthropic goals. Charitable trusts offer flexibility and some control over your intended charitable contributions as well as lifetime income, thereby helping with retirement, estate planning and tax management. This is an irrevocable transfer of cash or property and are required to distribute a portion of income or principal to either the donor or another beneficiary. At the end of the specified lifetime or term, the remaining trust assets are distributed to a charitable remainder beneficiary. Investment income is generally exempt from tax. This makes the CRT a good option for asset diversification. You may consider transferring low-basis assets to the trust so that when sold, no income or capital gains tax is recognized on the sale. However, the named non-charitable beneficiary will pay income tax on the income received.

Benefits:

- Preserve the value of highly appreciated assets by contributing the asset to the CRT, sell it within the trust as tax-exempt and eliminate large capital gains taxes, thereby donating the full value of the property to the CRT.

- Create an annuity-like revenue stream for your family during your lifetime

- Immediate potential to take a charitable deduction against the income or gift tax for the present value of the trust’s assets that are to pass to the qualified charity (the remainder beneficiary).

Considerations:

- Per the IRS, the annual annuity must be at least 5% but no more than 50% of the trust’s assets

- A trust’s term may be fixed but can be no longer than 20 years, or it can be for the life of one or more non-charitable beneficiaries

- There are some types of assets that should not be used to fund a CRT, including S corporation stock, since a CRT is not an eligible S corporation shareholder

- CRTs require some legal setup and ongoing maintenance costs

Source: Fidelity Charitable: “Charitable Planning Guide”

A Gift to a “Private Foundation”

Alternatively, rather than making a gift to a DAF or CRT, you could make a gift to a “Private Foundation,” i.e. a not-for-profit corporation organized by you and operated for charitable purposes. A private foundation is a type of charitable organization that typically is established by an individual, family, or corporation to support charitable activities. A board of directors or trustees oversees the foundation and is responsible for managing and investing assets and making grants to other charitable organizations in support of the foundation’s public mission. As its own legal entity, a private foundation offers broader license for grant-making activity and control over investments and management. With this flexibility, donors must also take on additional recordkeeping responsibilities and comply with more stringent tax rules. A private foundation is a very powerful charitable tool, but you should weigh all of the factors before jumping into this level of commitment.

Benefits:

- Establish a legacy beyond your lifetime and allow family members to be employed or serve as members of the governing board.

- A Private Foundation can be highly customized to meet a donor’s specific needs and wishes.

- With full control over grant-making, you can support more than just 501(c)(3) charities. By following proper IRS-procedures, grants can be made to additional causes including charitable programs undertaken by individuals, scholarship programs and other entities.

- In the long term, you can pass control of a Private Foundation to family members such as children who can continue the philanthropic work that you have begun.

Considerations:

- It probably doesn’t make sense to set up a Foundation unless you are going to commit $3mm or more in assets to the Foundation

- Charitable deductions are limited to 30% AGI for cash and 20% AGI for long-term publicly traded appreciated securities, as compared to the 60%/30% limits with some other charitable vehicle options

- You would have to bear the cost of creating the Private Foundation and qualifying it with the IRS as a tax-exempt entity. There would also be ongoing tax compliance costs for the foundation.

- A Private Foundation is generally required to distribute a minimum of 5% of its assets each year to public charities, and is subject to a number of technical rules about permissible investments.

- A Private Foundation cannot make distributions directly to individuals, but would be limited, like a DAF, to making payments to public charities.

- With respect to a Private Foundation created by you, there is a relatively high level of IRS scrutiny of transactions between you/persons in your family/companies you control and your Private Foundation.

Slight Variation: Gift to a Private “Operating” Foundation

Another alternative would be to structure a private foundation that is an “operating” foundation, i.e., one that can engage directly in charitable activities, rather than simply provide funding for other charitable organizations. The main disadvantage of this approach is that it is subject to the highest level of IRS scrutiny, both in terms of its initial creation and funding, and in terms of its ongoing operations. The regulatory burden imposed on these entities is (understandably) very high. Because of this high regulatory burden, the cost of implementation and operation will also be highest.

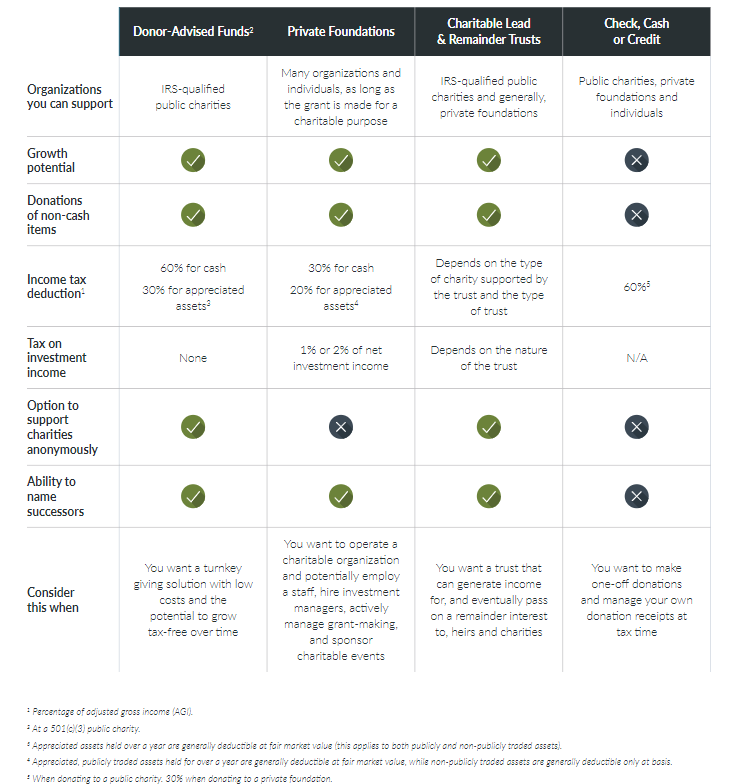

Fidelity is one of our custodian partners, so we will utilize their educational and marketing materials here, which pretty clearly lays out some of the main features and considerations for the ways that people typically give.

Giving Vehicle Comparison Chart

Exhibit 3 - Source: Fidelity Charitable: “Charitable Planning Guide”

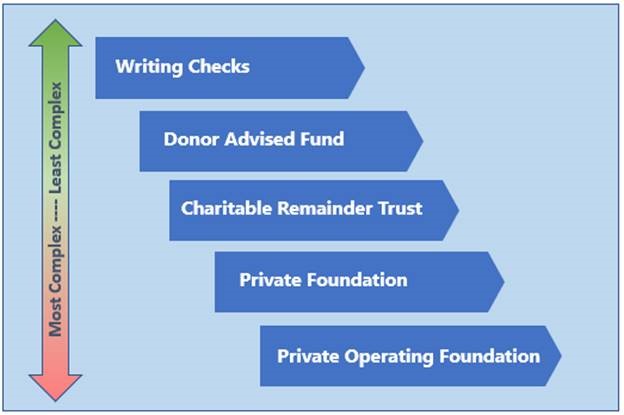

We have covered various ways to start giving and making your impact via philanthropy, as highlighted in Exhibit 4 below. Lots of people tell us that they get more out of giving it away than they did accumulating it, and that they never felt any poorer after making a pledge or starting a DAF or Foundation. Whether you personally get more satisfaction out of making it or giving it away, some of these approaches will certainly be worth considering at some point along your journey.

Exhibit 4 - Source: Intellectus Partners

Comments