There is a lot of attention for the yield curve lately. Several Fed officials like James Bullard and Neel Khaskari have warned the yield curve could “invert.” That would be a bad signal because historically when the yield curve inverts, a recession could follow a few years later. During the testimony to Congress, Fed Chairman Powell said flattening of the yield curve was a sign of long term rates figuring out when the Fed would stop tightening. Now President Trump has weighed in on that point specifically by expressing concerns rising rates push up the value of the dollar too far. That could threaten U.S. export competitiveness and undo the work of the tax cuts.

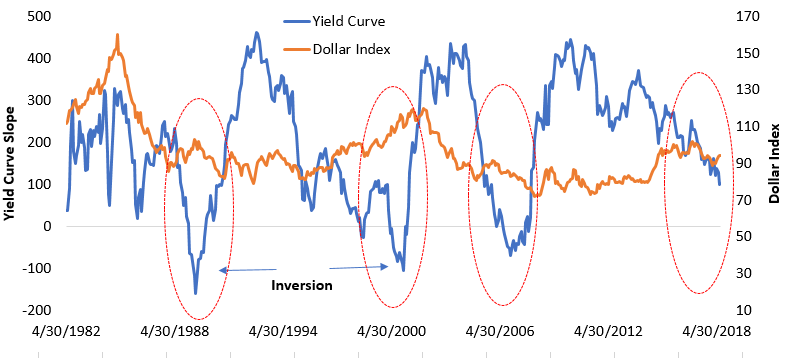

Thus, the yield curve is the center of attention for three reasons: 1) a potential inversion that could forebode a recession, 2) a sign that long term rates see Fed policy reach neutral and 3) the dollar could get too strong. In the past when the yield curve inverted, the dollar has appreciated by 10 to 20 percent (see orange line, Figure 1). But when the economy began to slide, the yield curve reversed to steepening (short term rates fell), and as consequence, the dollar depreciated by 10 to 20 percent. The relationship between yield curve and the dollar is important to what happens to the economy next.

Figure 1: The Dollar and Yield Curve

Source: Bloomberg

When the yield curve is flat or inverted, it says markets are pricing uncertainty for the economic outlook. That is in stark contrast with nominal GDP running currently over 6.5 percent. In recent Minutes from the FOMC published in January and June, several Fed members made a case for a “pause” in tightening. Their hesitation to go on raising rates is driven by “global factors” such as the Trade war, emerging market volatility, uncertainty in Italy and the Brexit.

And yet the dollar can remain strong because Powell is likely to speak a positive message about the economy. What results is the market will settle into a near flat and close to inverted yield curve with volatility very lows as seen back in 2006 to 2007. As proven in the past, low volatility and flat curve regimes can be a precursor to an uncertain or weakening economic environment. That likely leads to the result the dollar begins to decline and the yield curve becomes steeper. That will be the moment the market begins to think about the first rate cut by the Federal Reserve. We’re not there yet but by each day passing the yield curve gets closer to inversion and the dollar remains strong, the economic environment is likely to change such that lower interest rates are needed again.

Comments