The Federal Reserve’s FOMC Statement may have had the look of a stalemate but the language was crafted such that there are two important implications. The first is both sides of the dual mandate (inflation & unemployment) are in the Fed’s view now at target. The outlook for inflation was changed from “expected” to “will rise to 2 percent.” The Federal Reserve has high conviction inflation will be at target by removing from the Statement “transitory effects of declines in energy and import prices dissipate.” The other part of the mandate, the unemployment rate, was described as “stayed near its recent low” rather than declining. The assessment of the mandate coming into balance, suggests the Fed is getting ready for the next phase of tightening.

A second implication is the Fed is preparing for major government policy changes. This was seen in the Statement by the insertion of “measures of consumer and business sentiment have improved as of late.” The real economy response to future fiscal policy is on the Fed’s radar because shifts in consumer and business sentiment are generally leading. The shift in the Statement by inserting an observation of business conditions, and thereby diluting some of the past emphasis on inflation and financial conditions, is a relevant change.

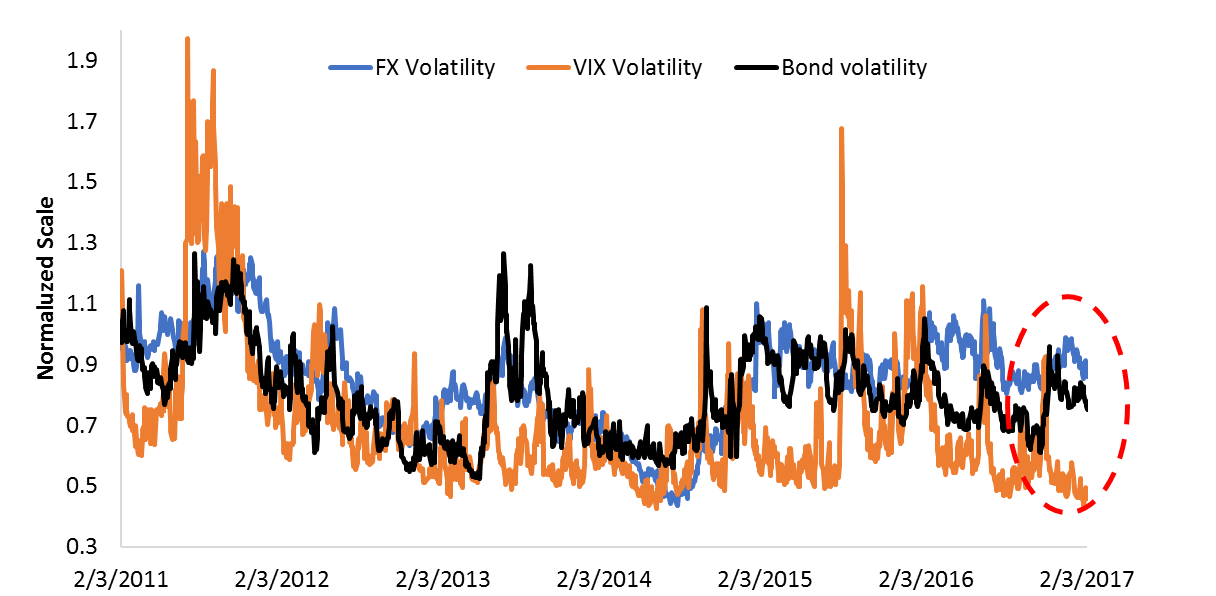

Markets reacted “stale” to the Fed Statement but yields, stocks and the dollar remain priced near elevated levels established post the Trump election. That suggests markets like the Fed are ready for the next stage in government policy. Markets are doing so by pricing in volatility dispersion across asset classes. Figure 1 says the equity market “believes” the new administration’s plan while the bond market and FX markets express caution.

A high level of volatility however implies an expectation of a wider range of outcomes. For investors that means with the Fed readying for fiscal policy, quicker tightening may happen if the economy responds positively. On the other hand, higher volatility expresses uncertainty about how much of the fiscal policy may come to fruition. Indeed, volatility says the Fed has put the market in a “stalemate” but not “checkmate.” Investor’s expectations for returns in most major asset classes are now elevated, as they need to be compensated for the heightened political uncertainty and volatility.

Figure 1: Dispersed Volatility

Source: Bloomberg

Comments