New Federal Reserve Chairman Jerome Powell’s first congressional testimony made it clear to markets that it’s no longer business as usual.

Under Powell’s predecessor, Janet Yellen, developments in the labor market drove monetary policy. And since employment is a lagging economic indicator and slack in the labor market was large, it was an easy message to convey. Monetary policy would gradually adjust as the labor market showed steady improvement. As a result, market volatility was subdued because a stable and moderately growing labor market became quite predictable.

But with Powell saying that he considers the labor market to be “beyond full employment,” fiscal policy must now be considered, driving the Fed toward a message that is focused on the uncertain effects of fiscal expansion on the economy. As such, Powell will have a more difficult time assuring markets that Fed hikes will remain gradual. Fed Governor Lael Brainard said in her speech the shift in fiscal stance in an economy at full employment is “tipping the balance of considerations for Fed policy.” That suggests the Fed could take a different rate hike path should the economy accelerate.

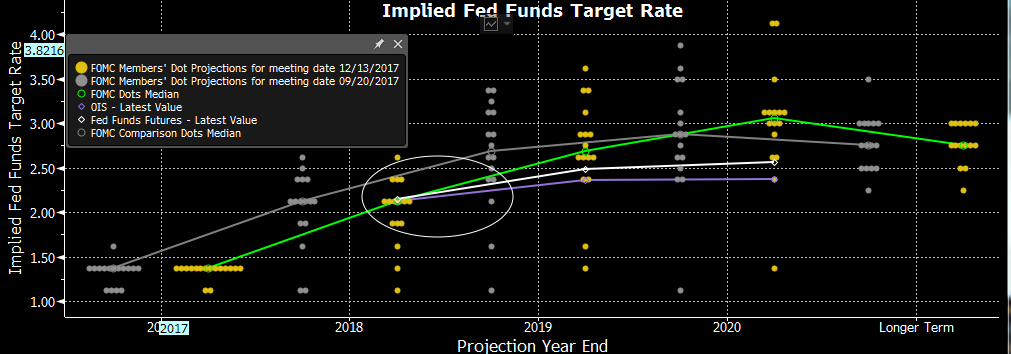

Markets are beginning to catch on to this message, with volatility rising back to long-term averages. Investor attention has shifted to how a stronger economy could move the Fed to a faster pace of interest-rate increases. Even without much additional economic data to inform decisions, the market’s expectations for the federal funds rate have risen to the 2018 median and nearing the 2019 median of the “dot plot”, the Fed’s forecast for the Fed Funds Rate (see Fig. 1).

Figure 1: Dot Plot

Source: Bloomberg

The fact that the market's outlook on rates is close to the Fed's view marks a change from recent history. For most of the post-crisis era, markets were --correctly -- projecting fewer rate hikes than the central bank. Now, however, investors are concerned that a rising fiscal and trade deficit may spark faster inflation. The weakening dollar, which makes imported goods more expensive, is also adding to inflation concerns.

Yellen had an easier time communicating monetary policy because it was largely based on a steadily improving labor market. As such, that kept a lid on volatility, since investors knew what was coming and when, often before the Fed knew what was coming. Powell will have a much harder time because fiscal and trade policies have entered the equation. The phrase “data dependent” is no longer applicable and that can serve as a catalyst for a higher level of volatility across asset classes.

For investors, returns will likely be lower after adjusting for rising volatility as the comfort of the Fed’s gradual tightening trajectory is overtaken by the uncertain effects of fiscal and trade policy. We are already seeing increased volatility in economic data, which has caused financial conditions to tighten a bit of late and indexes that measure data that exceed forecasts relative to those that miss to turn lower.

In the past, the Fed would delay tightening plans when markets were in disarray. During the European debt crisis and the credit crisis of early 2016 the Fed turned defensive and moderated its rate hike forecast down. Powell stated during his first Testimony that policy is less likely to prevail because it creates a situation of “falling behind curve.” That could result in faster tightening that could cause a recession, the opposite from what the Fed intends to do. A consequence of the Fed’s new and different message is markets can rely less on the “Fed put” when a crisis emerges.

Comments