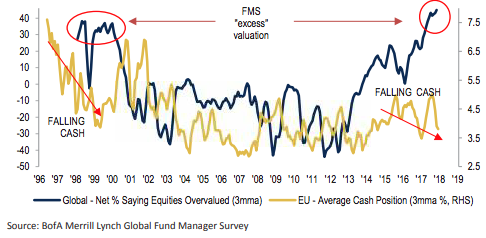

Cash can be a valuable commodity when returns on financial assets turn negative. After all, cash is easy to manage, has no volatility and doesn’t result in losses. Yet, cash is not abundantly available judging from global surveys such as by Bank of America. Those surveys are conducted among a diversified base of global investors. Respondents see excessive valuations and yet, portfolio cash levels have fallen to pre-crisis (see Fig. 1). A growing wedge between the perception of valuations and cash available to invest could pose a dangerous combination.

Figure 1: Stretched Valuations and Falling Cash levels

Source: Bank of America/Merril Lynch. “EU” = European Union. “Global” = global investors. “FMS” = Fund Manager Survey

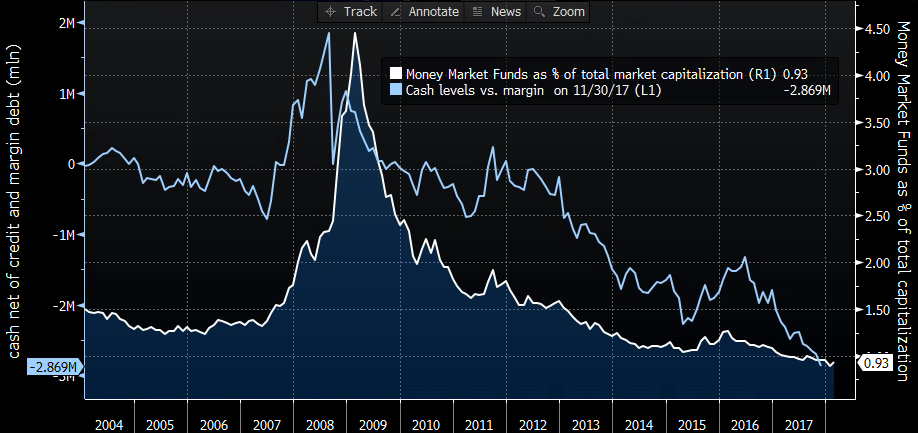

During the most recent bout of volatility, investors with significant cash positions likely fared much better than fully invested bond or stock portfolios that saw declines anywhere from 2 to 10 percent according to Barclays Bloomberg index data. Investors with sufficient cash are therefore in a preferential position. In political theory this is known as the “cash nexus.” When capital and labor are totally controlled by monetary transactions, cash provides power to a few privileged in society. Currently, there are not many investors who are in a position of abundant cash. For example, cash in portfolios net of margin is negative and money market funds have dwindled below one percent of total U.S. market capitalization (see Fig. 2).

Figure 2: Cash and Margin

Source: Bloomberg

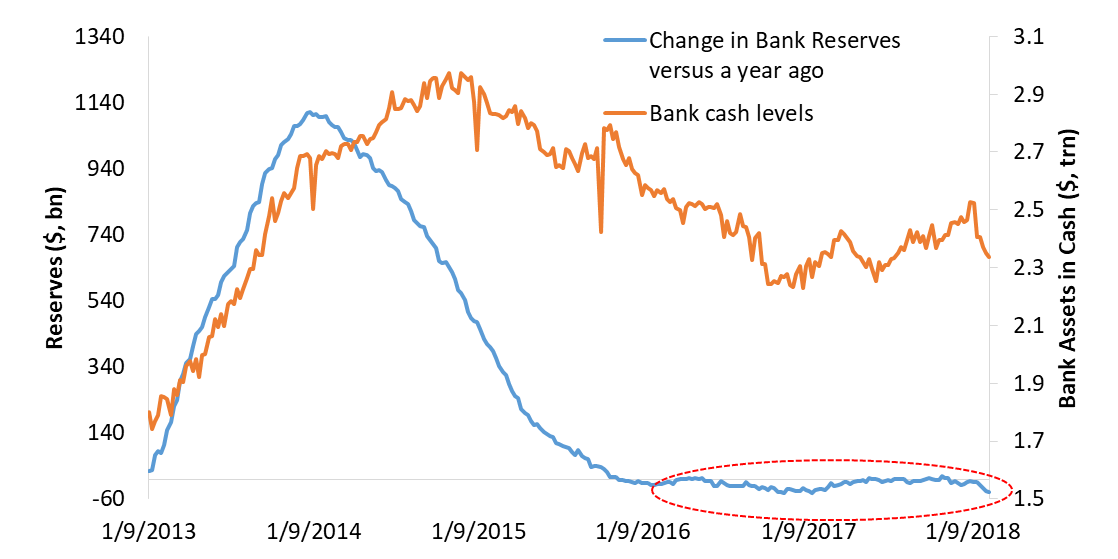

Low cash levels in institutional portfolios comes at a time the Federal Reserve has begun to withdraw cash from the financial system. Since last October, the Fed has reduced excess reserves by over $20 billion as part of the “reinvestment cap” set on maturing bonds on the Fed’s balance sheet. Commercial banks’ cash assets have also fallen since late 2014 when the Fed ended its QE3 program. At current pace, cash withdrawal by the Fed and bank’s cash asset shrinkage could amount to more than $150 to $200 billion by the end of 2018.

Figure 3: Fed Cash Dwindle

Source: Bloomberg, Federal Reserve

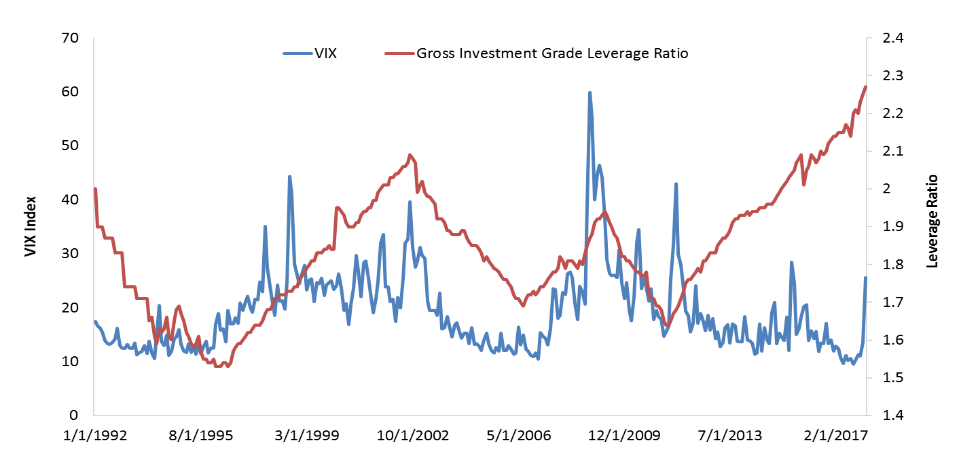

If there is less cash available and concentrated in the hands of a few, the impact on the financial system’s leverage could be meaningful. In recent years, financial leverage has risen to a record high driven by a low volatility and low interest rate environment (see Fig. 4). Recent string of inflation data caused a reassessment among investors that interest rates have to normalize further. When financial leverage is high and cash levels are low, shocks of volatility are to occur more frequently. A low level cash and rising rate environment could lead to unwind of financial leverage.

Figure 4: Leverage and Volatility

Source: Morgan Stanley, Bloomberg

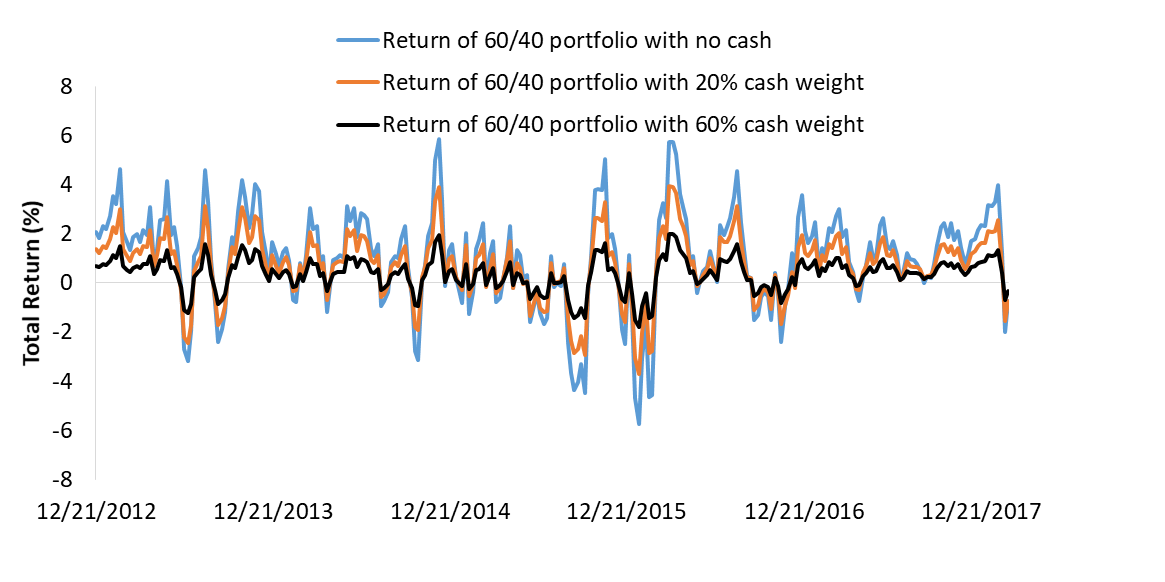

Financial markets are perhaps experiencing a cash nexus. Investors that are flushed with cash have the “power” to maneuver. Their portfolio returns are more stable than those of investors that are “cash strapped” (see black line versus blue line in Fig. 5).

Investors with less cash can experience quicker negative returns since they lack a cushion against rising volatility. When the next bout of volatility occurs, 60 percent stock and 40 percent bond portfolios could be adjusted with a greater cash weight to avoid significant drawdowns. That is the moment when deleveraging of the financial system on a larger scale starts. Current low cash levels are therefore a sign such an event could happen in the future.

Figure 5: Cash Portfolios versus Traditional 60/40 portfolios

Source: Bloomberg. 60/40 portfolio is 60% weight in S&P 500 index and 40% in Barclays Aggregate Index. The 60/40 portfolio is adjusted by taking a 20% weight in the Barclays T-bill index and adjust S&P 500 weight from 60% to 40%.

Comments