The markets have been very challenging in 2022. Through late May the S&P is drawdown has thus far peaked 19.9%(let's call that 20%), the NASDAQ and the Russell 2000 is off 31%, and world indices are negative 18 to -25% in local currency terms. In other words, it has been a very tough year and it is not likely to get better anytime soon.....or is it?

This last point gets to the premise of this post. What is the outlook for the markets? It is the one question which everyone has an opinion. It is the one that almost every guest in CNBC or the financial news is asked as soon as they arrive. This question drives debate, it drives passionate responses and viewership and trading commissions. All good things for the Financial Cabal as they make more money off of that drama. So, like it or not, everyone wants the answer to that question. But the truth is, not only do NONE of these people know (but yet they still offer opinions), even if they did know it may or not be even relevant to you. The reason is that 99.99% of the time, the people asking this question are really asking "when is the pain going to stop." They are focused on the very short term. They are not really asking about the long run direction of the market. They don't because they actually do know the answer to this question. We all do. More specifically, we know the statistics. This is the fact that over time the markets rise and on any given year the odds that the market is up is about 75%. In spite of this we all ask about the short term action and direction. But, if you want to generate wealth in the markets and create strong long run returns, the past has proven to us that these corrections no matter how deep or how long, eventually turn into the greatest opportunity sets for creating those long run returns. As Warren once explained in a letter to his partners, “This is the cornerstone of our investment philosophy: Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results.” it is the Bear Markets and Corrections that offer up the most attractive prices.

It is important to not let the Short Term noise, news and volatility pull your focus away from your Long Run Strategy and approach.

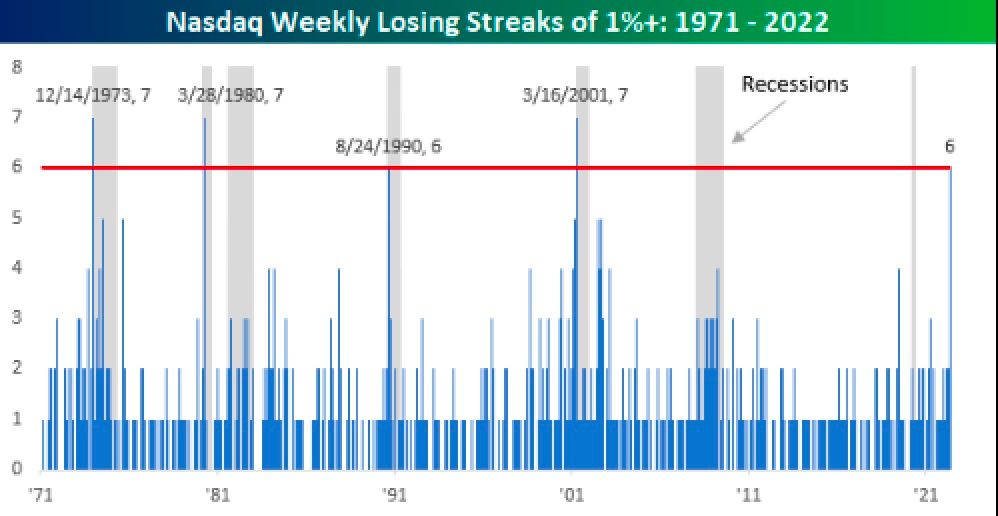

So, when we look at the Bear Market that we are in today, it is normal to be uneasy and concerned. We all are seeing so many negative scenarios. The FED is raising rates and tightening policy as aggressively as it has in a couple of generations. The economy is seeing rampant inflation. China has literally shut down their economy, the world's second largest. Global Supply chains are a wreck and this seems to be intractable. We have an Administration that is - at best- asleep at the wheel. So, yep, the set up is terrible....But we ALL know that and while "The Markets know nothing", they do discount news fast and that is what the markets are in the process of doing now. In fact, it does appear that the markets believe that we are in or near recession as the graphic below shows (Gray bars are recessions, Blue lines are consecutive down weeks on the NASDAQ).

This was not the case a year ago, when stocks were at all time highs. That was not the case in 2018 when stocks hit all time highs. That was not the case in any period where stocks were ramping. The point is, it is these periods of uncertainty are not to be ignored, but it is important to keep your head about you so that you and your team can focus on putting capital in the places that it will be treated best on the way out of the funk.

Unless you are a Trader, it is the focus on the next Quarter or two that can distract or force bad decisions that cost you your long run gains. Given where we stand today, with the market deep into correction territory, it is not particularly constructive to worry about the next near term move in stocks. Yes, you want to manage risk and limit market impacts, but you want to also look out over the next 12-24 months, not the next three.

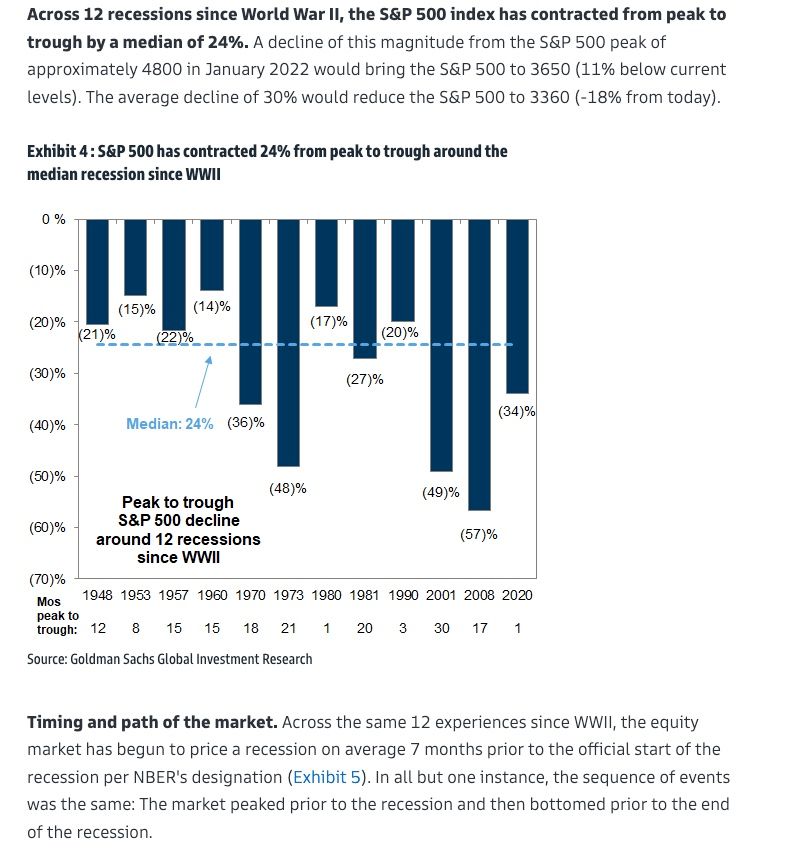

In a note published just today, Goldman Sachs highlights the context of Bear Markets during US recessions since WWII. While the outcomes vary widely, the S&P mean peak to trough correction is 24%. That is about 5% below the lows of last week. The point being that, while no one knows just when this will end or how low the market goes, we do know that the amount of bad news that is being priced in at this point is creating opportunities for savvy investors.

There are clearly bargains to be had as there are areas of the market that are now getting very inexpensive. That is not to say that the S&P is unusually cheap yet - at 17x NTM. But here are some examples of very inexpensive PE levels:

NYSE Composite 13.3x (10 yr avg 17) S&P Mid Cap 12.7x (avg 19), S&P Small Cap 12.6x (avg 21), MSCI EAFE Index 12x(avg 17), EuroStoxx 50 11.5x (avg 15), Shanghai Composite 10x(Avg 15), Brazil Bovespa 6x (Avg 28)….most of these are at or near 13 year lows. As Buffet says, the price you pay is important. So, it is important to not ignore prices that are on sale even if the near term outlook is not that bright.

Just like sailing on a boat in the Sea. If you are in rough waters and you only look down inside the boat you are likely to get Sea sick. But, if you focus your attention out over the horizon, you don't get Sea sick. that is the best metaphor for investing. It is where you will find dry land and maybe even the goal of your destination!

Comments