Just as the Fintech boom was created by the collapse of the US banking sector in 2008, we believe that the world is undergoing a similar innovation boom in Healthcare derived from the Covid-19 crisis.

As we all know, there was a multi-trillion dollar investment opportunity revealed to the world by the Great Financial Crisis in 2008-09. We now call that boom, the FinTech Industry. From nowhere pre crisis, the global fintech sector is expected to be worth US$309bb in 2022 with a CAGR of 24%, according to PR Newswire.

- The fintech market share across 48 fintech unicorns is now worth over US$187 billion (as of 2019). That is slightly over 1% of the global financial industry.

- A study by Goldman Sachs estimated that fintech may eventually disrupt up to US$4.7 trillion of revenue that traditional financial services now make.

- Likely to maintain a CAGR of 22% through 2025

At the time the collapse in the US Banking sector created a massive crisis of Epic proportions. It took all of the world's governments and Central Banks to pull out all of the stops and lever up their balance sheets to stabilize global markets. Thankfully, they were successful. But the damage was done and a crisis of confidence erupted...and still has not been healed.

That crisis exposed the terrible conflicts of interests and failed business models that most Banks, Investment Banks and Brokerages were trying to maintain. It also allowed an opportunity for advancements in technologies already under early development to emerge as primary causes of that disruption. In fact, Intellectus is a small part of that eruption as our firm was launched on the bet that wealthy clients wanted a more honest and transparent approach to advice and Investment Management. Our leveraging of these emerging technologies catapulted by the crisis allowed us to not only compete with those Banks, but in fact win.

All of this ushered in an entirely new Industry with many staggering winners. Square, Paypal, Stripe, Ant, Adyen, SoFi, Robinhood, Chime to name just a handful. Actually, just the top three Payments companies Paypal, Square and Visa alone are worth more than $1 trillion...That is more than the US six largest banks! More than $14.8bb was invested in the FinTech ecosystem in just 2019 alone...and that does not even include Bitcoin. At $600bb in market value, the mother of all anti-establishment investments.

The Covid 19 Crisis - economically - equates to the Great Financial Crisis

Many of these leading companies were founded after the GFC bust and most importantly...they were founded because of the bust! That crash catalyzed an already trebling sense that there must be a better way than what we knew and the simultaneous emergence of certain technologies allowed it to happen. The rest is history.

We are seeing history repeat itself...and you do NOT want to miss this one! So, just as we saw the FinTech boom created from the crisis of the banking crisis, we are now witnessing a Boom in Health in both public and private markets created from the Covid-19 crisis.

Fast forward from the GFC - about a decade to March 2020 to the breakout of the first Global Pandemic in two generations and the worst in 100 years, Covid-19. As we all know now, literally everything has changed. We have been forced to shut cities, businesses and schools. Nearly all human activity on earth is in question or under the strict surveillance of Federal Governments. Constitutional Rights have been ignored, politicians are utterly clueless and in complete disarray, the world is in a panic. More than 85 million people have been infected, millions of families have been disrupted, millions of people have died. The full, long term health impact of Covid has yet to be calculated but it is certainly in the trillions of economic costs already. Now, ten months into this pandemic, we all think and behave differently. The economic impact will be profound for generations.

As has been said, "There are decades where nothing happens, and then there are months where Decades happen". That is where we find ourselves today. Covid has accelerated almost everything related to Health and Wellness. Things that were expected to develop over many years are now upon us in full force - and this is good for our collective health. We now have multiple Covid Vaccines in market after just 10 months of development. The average vaccine typically takes 10 years to develop! The urgency created by Covid is crystalizing into a powerful investment tornado and we see this as one of the biggest of our lifetimes.

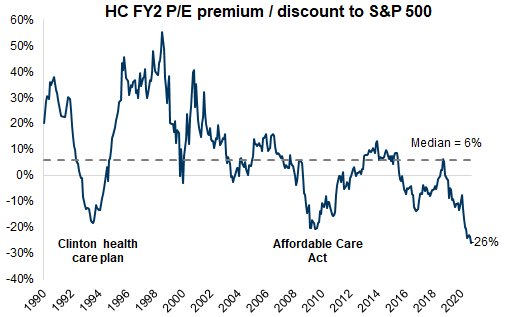

Proposed and enacted regulatory changes have been significant and have already begun implementation. From the Trump Administration plan "Warp Speed", which dramatically accelerated the development of Covid vaccines, to the cutting of FDA red tape reducing drug clearance times, it has been a surprise tailwind. "The result has been greater efficiencies such as earlier proof-of-concept, higher probability of success, and greater effect size upon success. According to BTIG, "These elements have led to a greater number of average new drug approvals per year over the past five years (44.6) than in any five year span since at least 1990". With the prospects of a new Administration just ahead of us, that could indeed flip to a risk. But, it appears that the horse has left the barn with regards to the benefits of a more lenient regulatory approach. Either way, the markets have certainly priced in the years of suppressive regulations in healthcare as evidenced by those most exposed to high regulations trading at the biggest historical discounts.

Innovation, above all else is the rationale...the advent of Artificial Intelligence, Data science and more integrated data sharing are creating greater accuracy, speed, effectiveness and transparency for consumers. The use of biomarkers within trials has been increasingly employed for awhile with increasing regulatory acceptance. These enriched trial designs that use advances in genetic research have made some medications more effective and easier to test. Centers for Medicare & Medicaid Services (CMS) and the Office of the National Coordinator for Health Information Technology (ONC) are making changes to promote data sharing between healthcare organizations. These regulatory changes also include interoperability of electronic health record data and increased rate transparency for consumers and may help eliminate the data silos that have historically prevented end-to-end care analytics. The National Institutes for Health (NIH) has been a steady bulwark of BioHealth research development. NIH funding has steadily increased annually to over $7bb in research grants in 2019.

From Distance Learning and Medicine to Remote monitoring, Precision Medicine, Covid Tracking, Real time data analysis to identify disease hotspots, Cloud based patient monitoring, 3D modeling, Robotic & Remote Surgery, Aesthetic & Cosmetic surgery, digital & mobile health and wellness and Fitness are all areas within HealthCare broadly that are being transformed. According to a 2020 AMA Digital Heath Report, TeleHealth usage alone has grown more than 100% in the last three years- and that was at the beginning of the Pandemic! The Mobile Health Market is forecasted to grow to $250mm TAM by 2025. Companies sponsoring Immuno-Oncology trials is now growing at a CAGR of 27%.

The "Set Up" is excellent

As a sector, a "cyclical recovery" is likely. According to Goldman Sachs "US hospitals will likely end 2020 with inpatient surgeries down about 12% and outpatient surgeries down more than 15%, with the elderly making up the lion’s share of these missing procedures. Our new category-by-category analysis of this potential backlog of risk averse patients suggests a major -- and potentially still under-appreciated -- tailwind to Medtech growth after vaccinations, starting in 2H21 and lasting for two or more years. Specifically, we believe this backlog should be incremental to what would otherwise already be largely normalized procedure volumes by 2022". Additionally, for Diagnostics and Life Science Tools providers, earnings will likely reaccelerate as labs reopen and budgets expand.

Possibly the best markets rationale as to "why now?" is that as a "sector" Healthcare is cheap. As the graphic below, courtesy of Goldman Sachs/Factset shows, as a relative value to the market, this is a good place to be in an otherwise expensive marketplace.

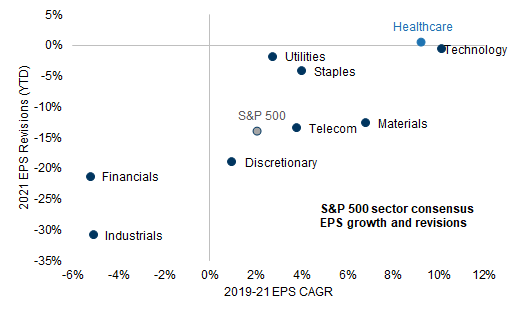

Yet, this does not appear to be a value trap, as growth is second only to Technology, as seen below (*GS/FactSet)

Innovation is everywhere

Artificial intelligence in drug development is accelerating in leaps and bounds - because it works. The combination of the rapid improvements in computer processing, Cloud based systems, learning algorithms, and the availability of large datasets sourced from medical records and wearable health devices, these AI-based systems are already improving the accuracy and efficiency of diagnosis and treatment. Frost & Sullivan estimates that the savings derived by AI in Healthcare to reach $150bb by 2025! https://ww2.frost.com/news/press-releases/artificial-intelligence-healthcare-takes-precision-medicine-next-level/

As recently as November 2020, Deeepmind (an Alphabet company) announced a major breakthrough by using an advanced Neural Net aimed at biology. As respected Scientific Journal "Nature" said..."a gargantuan leap in solving one of biology’s grandest challenges — determining a protein’s 3D shape from its amino-acid sequence". It could significantly accelerate our ability to understand the building blocks of cells and enable quicker and more advanced drug discovery completely transforming biomedical research, bioengineering and medicine at large.

Researchers can only study so much information about the application of a chemical compound to a particular treatment and the myriad interactions. Systems using Machine Learning and Neural Nets, however, can crawl, aggregate, visualize and contextualize troves of unstructured data to help identify possible applications and get them to clinical trials much faster. The Cloud infrastructure that is now the basis of all fast growing businesses is being leveraged in these data intensive businesses in healthcare and Biotech specifically. In fact, the world’s first drug to be developed using AI is entering Phase I clinical trials. The long-acting, potent serotonin 5-HT1A receptor agonist, DSP-1181, could be used to treat Obsessive Compulsive Disorder was created using Exscientia’s AI platform. While the standard research time for a drug such as this would be at least five years, the use of AI technology managed to reduce this down to just 12 months, a 500% improvement in productivity.

The price to sequence an entire Genome has dropped at such a staggering amount it makes the progress of Moore's law pale in comparison. In 2000 it cost $2.7bb to Sequence a genome, today it costs $300. Gene Therapy, Crispr9 are related DNA sequencing are building an analog of the human body as a nearly programmable system.

Jennifer Doudna and Emmanuelle Charpentier just won the 2020 Nobel chemistry prize for their discovery of this game-changing gene-editing technique. Patients with genetic diseases had DNA "errors" repaired by using CRISPR with appropriate clinical benefits, ushering in an era of programmatic repair of genetic diseases! This particular technology is so transformative to medicine that it brings some of the best and worst Sci-Fi fears of intentionally altered and cloned species to the fore - including humans. Not quite "The Singularity", but it certainly is getting close to a "code for human programming". The human and business impact is massive. Where just five years ago this "industry" did not exist, it is expected to grow at a CAGR of 36% per annum to more than $4bb by just 2024!

Another brand new market, ushered in by the incredible innovation by companies such as Grail (acquired by Illumina in advance of their own IPO for $9bb!) to create a rapid, effective and non invasive test for cancer - "Liquid Biopsy" is now expected to grow from zero to $12.9bb market by 2030.

Oncology research is seeing a level of advancement that have led some experts to predict that even Cancer will be a treatable and manageable disease in 25 years, much like HIV/AIDS. Diagnostics testing can be one of the most powerful agents against the disease. According Allied Market Research the Genetic Sequencing market is expected to grow to a $25bb market by 2025. A CAGR of 18% per annum from 2018.

Cancer is a horrible and massive cost on society. The patient population is still growing at far too large of a rate. The unmet need is huge with 5 year survival rate still under 30%. The patient population is up to 30,000 patients per year in the US alone.

While the human tragedy is horrific, there are signs that technologies are rapidly improving possibilities. From CAR-T therapies, to use of viral vectors, Cell, RNA, Gene, and Stem Cell therapies are emerging with real promise. Immuno-oncology, while increasing complexity is also emerging as a focus approach. In CAR-T alone, there are already hundreds of agents being tested with an expected sales of over $6bb by 2024. Oncology as an "industry" is expected to grow at a 13% CAGR to $150bb per annum by 2023. The markets are eager for new Oncology companies as evidenced by the fact that one of the strongest new issue sectors in healthcare is in fact Oncology. The number of IPOs in the sector has doubled in just three years. In the last 5 years the median size of just Oncology focused M&A transactions has risen over 100% to over $5bb.

There is a healthy positive feedback loop happening in Biotech at large as there was for Tech in the 1990's. According to Statista, there are currently more than 1,200 Oncology based medicines in development in the US alone. More Life Science companies are getting to market, that means more capital formation, which means more money going to top management teams to spend on more R&D. All the while the technological tools are scaling and speeding development. This means larger companies moving faster and attracting larger Institutional investors, which raises valuations. This creates much greater liquidity and liquidty itself attracts capital. In the first half of 2020 total Venture funding of health innovation hit a record $9.1bb, up 19% year over year. The 2020 IPO performance of the sector outstripped 2019 with 70% more IPOs and 45% higher average IPO price, contributing to 150% higher total amount of funds raised (FactSet).The 2020 class of new issuances have performed very well, with 49 of 60 IPOs now trading above their initial offer price as of Dec 2020.

In Summary

Why are we so bullish on "New Health"? There is really one simple reason...what is more important than one's health? Nothing. Who doesn't want to live a life without pain and disease...and even possibly aging! Thus the combination of advances in technology with a generally inelastic demand will drive this to an investment opportunity that will dwarf all that came before it. Technology is digitizing all industries and businesses. Those that are based upon IP are even more susceptible to it's impact. It is clear that many drivers are coming together simultaneously to create this massive opportunity. Why do we use Fintech as an analog to the New Health Opportunity? The similarities are too obvious to ignore. Two of the largest crises in generations hitting within a decade of each other, each transforming an industry and these two crises attacked what are generally considered the two most important areas of human focus, Health & Wealth!

The opportunity is still clearly ahead of us and the TAM's are huge. While the recent performance of Biotech stocks may feel as though this is not early, it is. The numbers bear it out. Here is one last fact to put the scale of the opportunity into perspective. The market value of the entire Biopharma industry- from the largest to the smallest is smaller than just the three largest Tech giants! Let's put history into historical perspective here. In 2000 the world's largest companies in the S&P were very different than today, with the likes of Exxon, Cisco Systems, Citi and GE leading the pack. Good companies, sure, but clearly times change and money flows to where it is best treated, so these things evolve. We think it is obvious that your money will be treated very well in Healthcare & Life Sciences over the next decade.

We plan on being there and capitalizing on this Boom as well....

*With special thanks to Goldman Sachs Research, Bloomberg, LLP, BTIG Research

Comments