As you will see in the following pages, we have been hard art work looking for what are the best values in the marketplace. The October selloff as expected has begun to open up opportunities for us.

While we have been saying for quite awhile that a correction was due, and that we would continue to see “growth scares”, we have been very patient at adding equity exposure. Rightly so.

Now that the market has hit a generic 10% correction, we deem this level as proper to get a bit more proactive on names. We are not yet calling a market bottom. Frankly, we think there is going to be continued volatility. But, we are now at the point where we begin to prepare for that event. We also want to point out that it is the end of the calendar year and SP500 earnings estimates have ramped dramatically throughout 2018 to a growth rate as high as 24% at one point. Now in just the last month that estimate is down to 17%. What's more, the 2019 estimate is still back to a more normal 5% eps growth. So, if I were the management team of a public company, I would certainly use the current environment at year end as an opportunity to lower the bar for the next year. It appears that there is much of that happening.

So, step one for us is always to look at what we already own. Do we want to continue to own it? It is one of the best 10 names we could own for the next 12-24 months? What is the relative downside vs upside opportunity? Has anything changed from our original thesis? And finally, are there better names to own for the next two years?

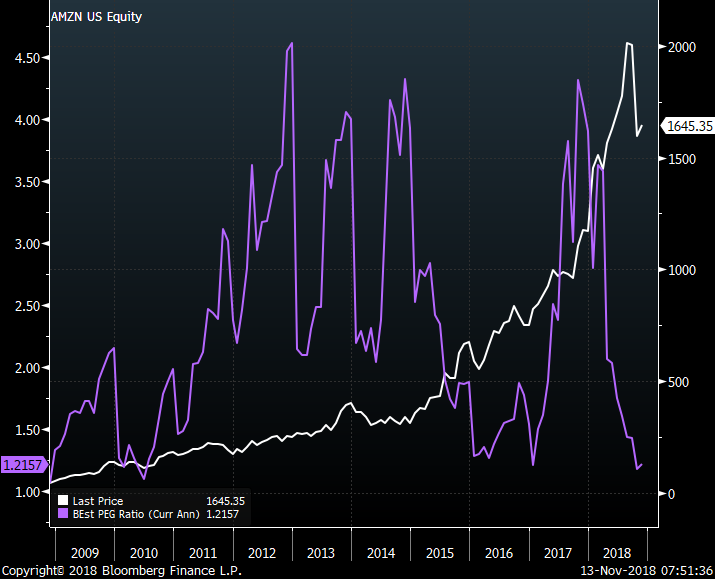

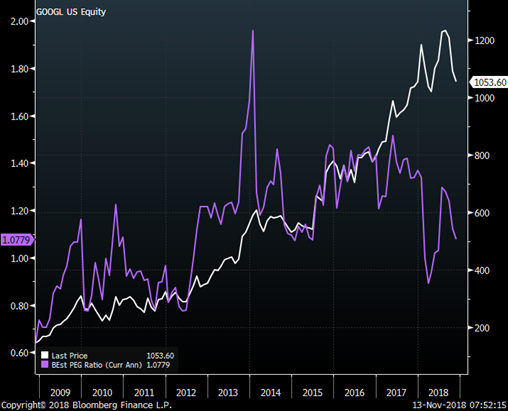

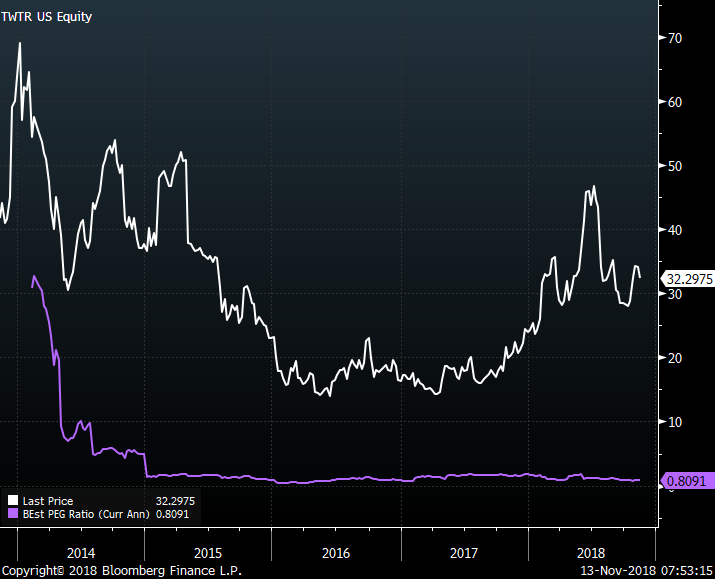

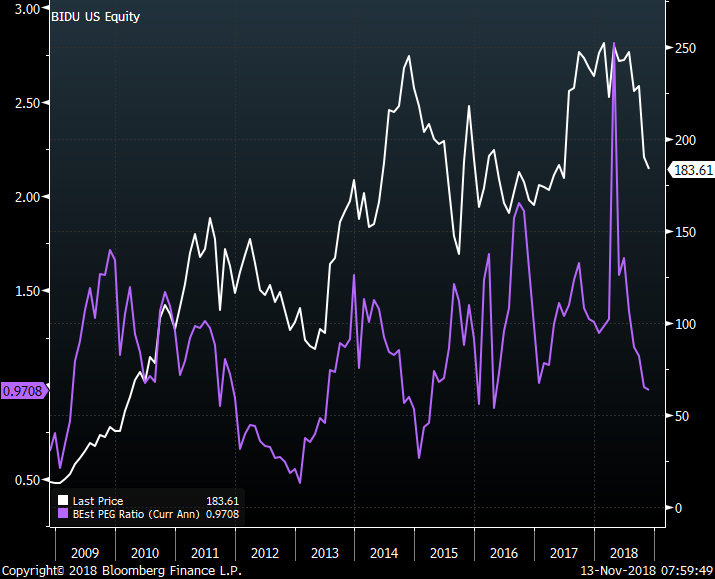

That said, in this piece we highlight some of the names we already have exposure to. The surprising thing is that some of these names still screen incredibly cheap relative to their growth. Some near record cheapness. While some others might surprise you in that, while they are great companies and generally have outperformed (even during the corrections), are very expensive now.

This is just one of our many screens that we run and so, no final decisions are ever made based upon a single metric. That said, we view this as relatively interesting. This is a simple way to find companies that are inexpensive relative to their growth prospects. Which, ultimately is what makes stocks work…

A few I will call out on the very cheap side (in no particular ranking or order) :

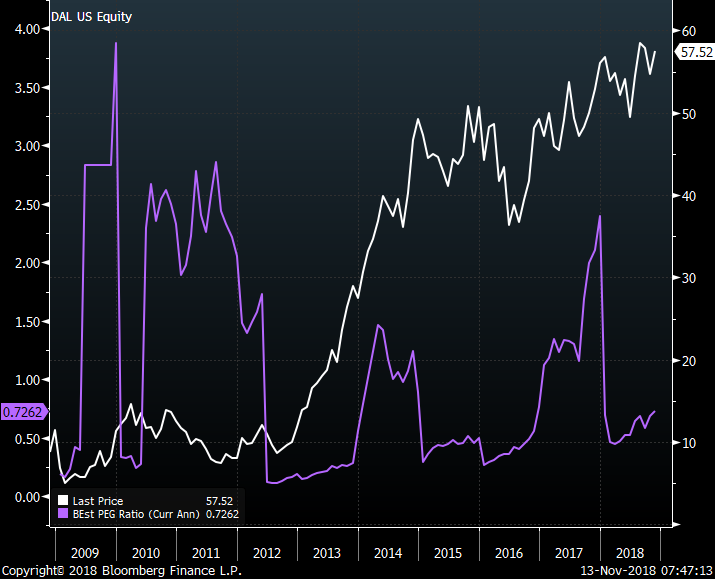

- Delta Air (DAL)

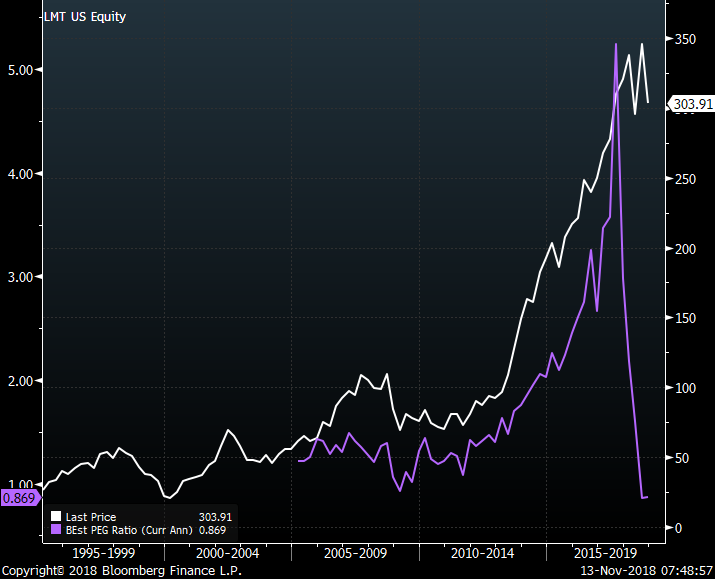

- Lockheed martin (LMT)

- Baidu (BIDU)

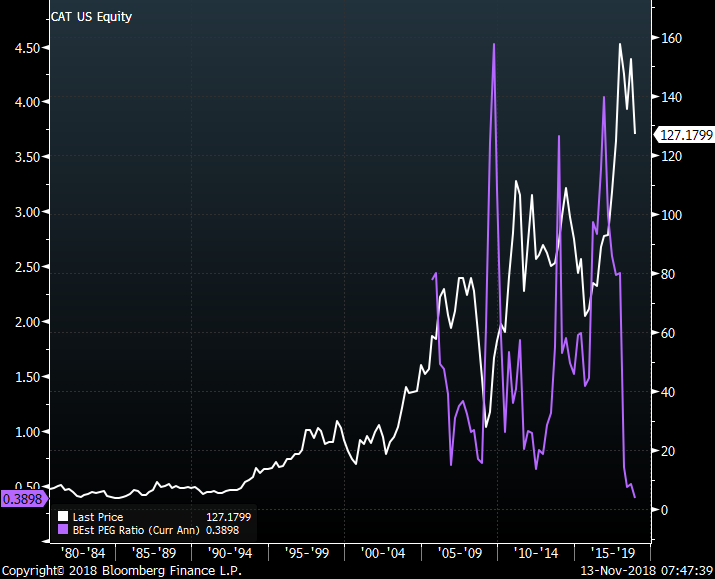

- Caterpillar (CAT)

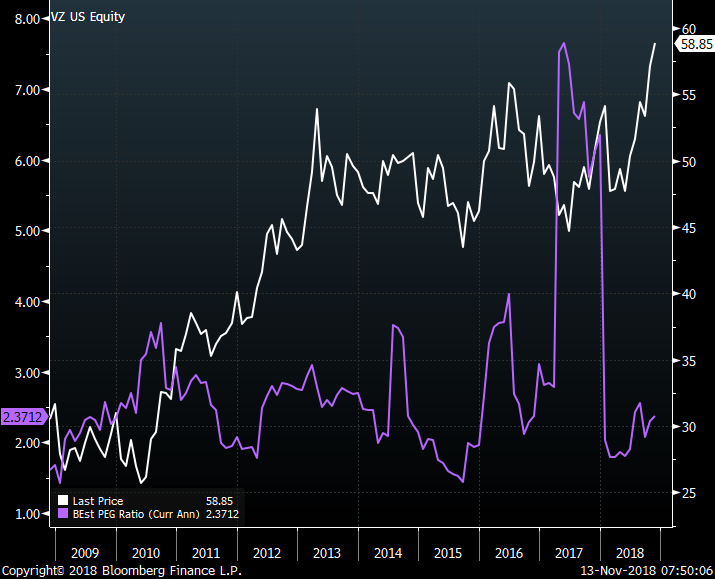

- Verizon (VZ)

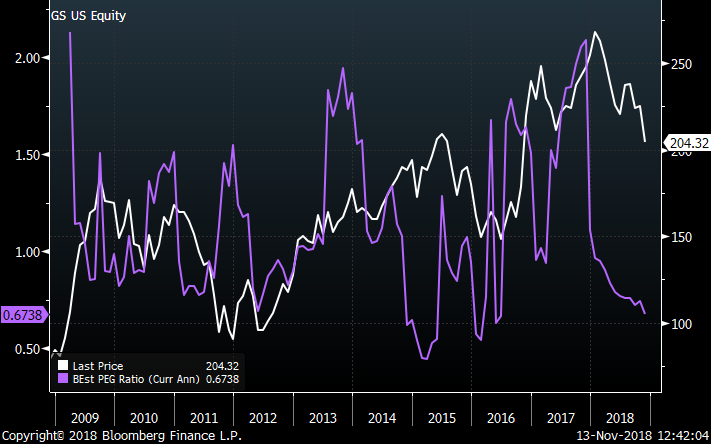

- Goldman Sachs (GS)

And two BIG surprises, because they have been such great performers…. - Amazon (yes AMZN)

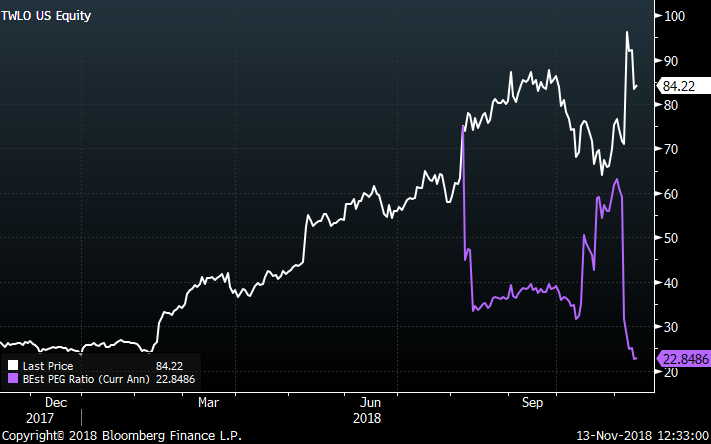

- Twilio (TWLO)

…and on the expensive side:

- Microsoft(MSFT)

- Apple (AAPL)

- Square (SQ)

- TJ Maxx (TJX)

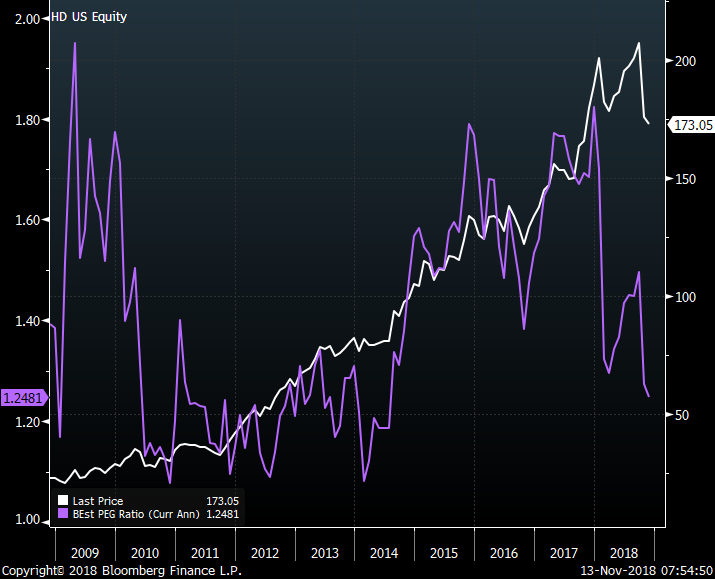

We begin with some stocks whose stocks are inexpensive relative to their expected growth outlook. Amazon(AMZN) 2. Google 3. Twitter(TWTR) 4. Baidu(BIDU) 5.Lockheed (LMT) and 6. Home Depot(HD) (Charts courtesy of Bloomberg L.P.)

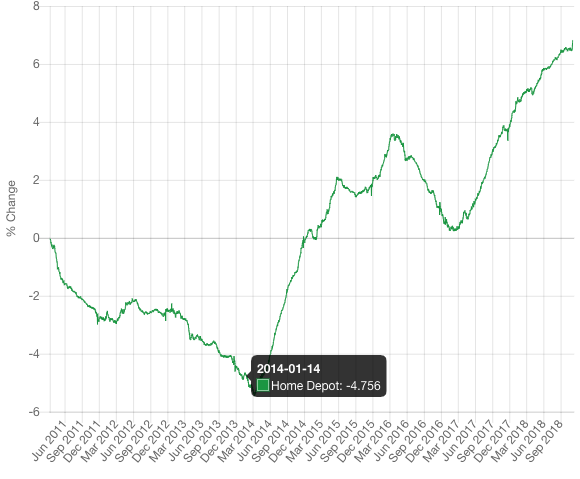

And here is an assist from the Geospatial Analytics Partner, Orbital Insight (www.orbitalinsight.com) where they show us via the Computer Vision and Artificial Intelligence algos, much of what Home Depot just said on their conference call. That is that traffic is surprisingly strong.

In this series we have:

Caterpillar at an all time low relative PEG,

Verizon showing surprisingly cheap given the big run it has had, and Twilio, which is one of the biggest surprises. TWLO has been on a tear but their growth outlook is one of the best we see.

Below you will see that Goldman Sachs (GS) is now at the cheapest it has been since the GFC, and

Delta (DAL), long a favorite here. This name still screens cheap because growth is improving

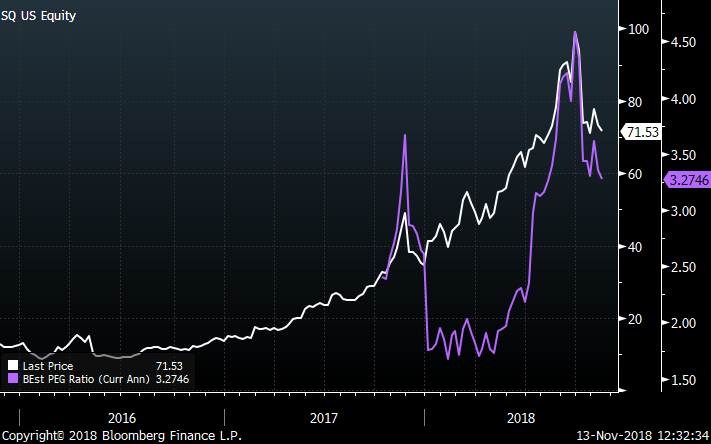

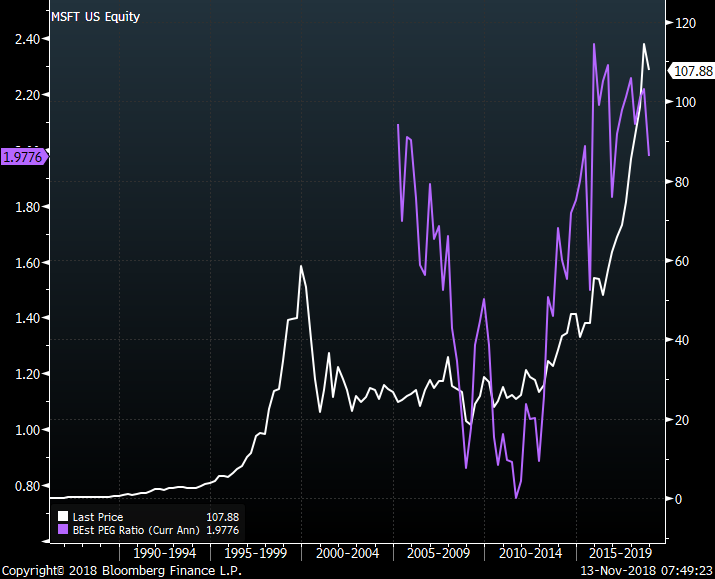

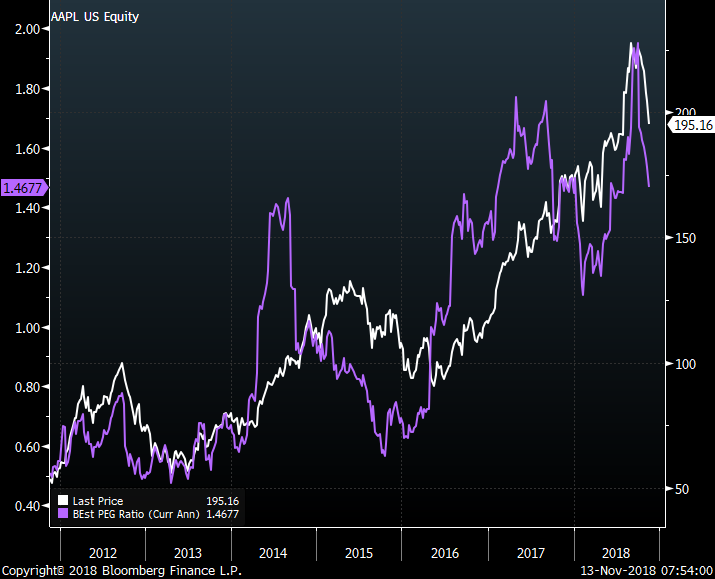

Here we have some stocks that have been great performers but now show us that they are expensive that that the market may have priced in their excellent business profiles. Square (SQ), Microsoft(MSFT) and the big daddy Apple (AAPL).

Our point here is not that all of the above are buys because they screen as cheap relative to their growth or tht they should be sold because they are expensive. There are obviously many other factors that matter here. But this is simply, a relevant way to look at a pool of really good companies that are showing up on our radar for a few reasons.

This is neither a recommendation to buy or sell any of the securities mentioned. Intellectus Partners may be long or short some or all of the stocks or companies in this post. We are not endorsing that anyone transact in any of these securities. If you choose to please consult a qualified financial advisor before you do so.

Comments