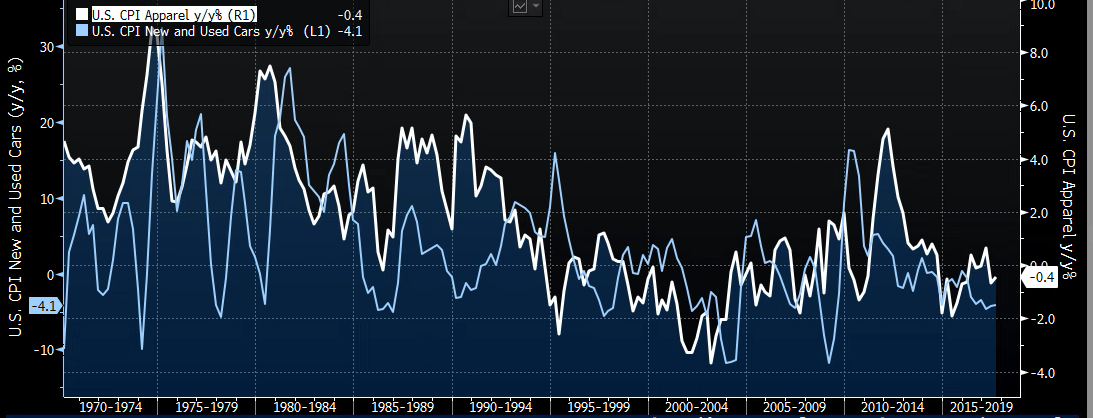

The latest Consumer Price Index release was the third consecutive inflation report that came out on the soft side. The economy has been moderately growing at 2 percent average with wages around 2.5 percent and unemployment around 4.3 percent. An economist who advocates the “Phillips Curve” (the relationship between unemployment rate and inflation) would argue the U.S. economy is on the brink of a burst in inflation. And yet, the actual inflation is benign and even shows ingrained deflationary trends across a variety of core goods categories. Such are new and used cars, cellular plans and retail goods. Figure 1 shows the long term trend in some of these categories. They have been in decline for some time. What is going here exactly?

Figure 1: Deflationary Trends in U.S.CPI

Source: Bloomberg

New and used auto prices have been on a decline since 2016 as the auto industry has to work off an oversupply. The glut of used cars coming to market after the increased pace of consumer leases over the last several years and the generally weaker-than-expected trends in business and consumer purchases of new autos have increased vehicle inventories and weighed on prices. There is also deflation visible in retail goods prices what appears to become a more meaningful trend. For example the Amazon’s Prime Day on July 11 caused a heavy discounting among major retailers, and that is a subcomponent of a broader disruption of the retail sector from rising e-commerce competition in the last few years.

During March and April there was an apparent large drop in cellular plans that got the attention of Fed Chair Janet Yellen. And just recently, New York Fed President Dudley acknowledged that technology may have a dampening impact on inflation that may last longer than previously thought. As a result, the Fed may not be able to reach its inflation target by next year. In light of last week’s CPI release, it is possible that the Fed’s preferred measure of inflation core PCE, may also fall in the months ahead. A result is the Fed must lower its expectations for inflation at the next FOMC meeting in September. If the Fed fails to do so, the credibility of the inflation target is at risk. That could mean U.S. inflation expectations drift down further and may resemble what happened in Japan.

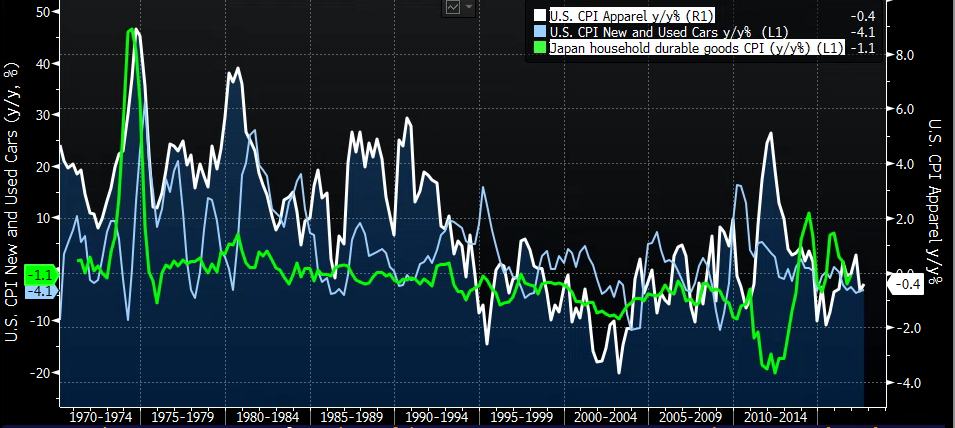

There is some parallel to Japan where household durable goods CPI has been in deflation since the middle of the 1990s (see green line Fig.2). Components of U.S. CPI like apparel and cars are following a similar trend since the middle of 2000s. Given the trends in demographics and productivity, U.S. inflation is likely to stay more benign than what was experience in the 1970s. As such, the U.S. economy is experiencing “shadow deflation.” This is not necessarily bad for real incomes and the stock market but for long term growth potential to rise, there remain challenges ahead as a result of low inflation.

Figure 2: Japan Core Goods Inflation vs. the U.S.

Source: Bloomberg

Comments