What are the possible outcomes from the expected and stated tax policies of the new Trump administration?

Pragmatism v. Idealogy: What are the likely economic impacts?

Two years without gridlock? Given that the deck is now stacked for conservatives in that they control the White House, House of representatives and the Senate ...and likely soon the Supreme Court, expect a whirlwind first two years.

Here are some of our thoughts with assists from a few of our sell side coverage friends at some of the big banks.

The simple logic as to what has changed:

In the past Obama regime, we've had sub par growth but the FED was still raising rates. The consensus was that there was indeed some room for Chair Yellen to raise rates. But there was limited strength in the economy to move much due to the fact that Fiscal policy was non existent. Now we have a huge change in regime.

Today we have an even higher probability of rates rising in December (possibly even beyond the expected December meeting)and the markets are enthusiastic about it. So, you say why is the market now "ok" with that when before they were concerned? It is because of what we now finally have on the other side...the Fiscal stimulus.

There is now a series of programs that will stimulate and balance out the financial suppression that a lack of Fiscal policy was exerting on the economy.

What are those stimuli?

A. Lower Corporate tax rates

B. Lower Income tax rates

C. Roll back of regulations

D. Massive Infrastructure spend

These four Fiscal policy changes are all growth positive and have unleashed the "animal spirits" that we just have not seen yet in this "recovery".

What are some of the key themes to consider as part of your investment strategy as a consequence of this new policy stance?

1 Currencies: This a new USD Regime? Lower taxes, more growth and higher interest rates: Welcome back Supply side, we missed you

2 The impact of lower taxes on Growth.

3 New Sector Strategies emerge: De-Regulation takes hold on many industries. Banks benefit. Healthcare gets some oxygen. Tech still strong on a secular basis. Small caps likely ignited. A lifeline to Utilities and smokestacks-for a short while.

4 The FED: How high can rates go?

5 Repatriation and it's impacts

6 S&P earnings impacts from the "new trade": How to position your portfolio.

7 Was Nationalism rhetoric or real? How far will he go on the "protectionism" front?

CURRENCIES: A NEW Dollar regime?

Clearly a rising USD has significant impacts on global output and trade (please refer to Ben's post from Monday Nov 21 here: GHOST_URL/2016/11/21/the-effects-of-a-dollar-surge/). It is reflective of stronger US outlook but we are watching the impact of the move closely as it can create challenges for US exports and can put pressures on global trade. That said, if the US consumer feels more flush, employment broadens out, business and leisure travel pick up, and the consumer begins to open their check book again and begins spending, that could be offset.

Global GDP and US stock returns are different animals. The long run correlations between the USD and the US stock market is weak at best. We have seen historical periods of tight positive correlation (1980-85,1995-2000, 2009-2015) as well as periods of a strong negative correlation(2001-2006)

source:Macrotrends http://www.macrotrends.net/1329/us-dollar-index-historical-chart

source:Macrotrends http://www.macrotrends.net/1329/us-dollar-index-historical-chart

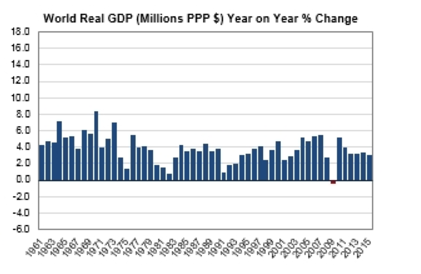

Global Growth:

A historical perspective to align with the historical USD trends. The USD clearly impacts growth globally, but sometimes it is a weaker currency that allows weaker economies to survive challenging periods. One could argue that might be a tonic for Europe. In fact, we may be seeing this in the UK following Brexit.

source: Worldeconomics.com http://www.worldeconomics.com/papers/Global Growth Monitor_7c66ffca-ff86-4e4c-979d-7c5d7a22ef21.paper

source: Worldeconomics.com http://www.worldeconomics.com/papers/Global Growth Monitor_7c66ffca-ff86-4e4c-979d-7c5d7a22ef21.paper

THEMES AND SECTORS: Bank Stocks

There has been a predictable rally in Bank stocks post election. Clearly, as we said in our Pre Election post on Nov 1, the markets were leaning too far in the wrong direction and that there were trades to be had. Bank stocks have risen sharply post election reflecting a combination of hopes for stronger economic growth, higher interest rates and less regulation. We are beginning to see material increase in earnings estimates based on these drivers.

Deutsche Bank estimates a 25-30% potential lift to EPS in their upside/very bullish scenario. This includes a panoply of upside drivers:

*Leverage from a pick up in lending and fees may be worth twice rate leverage.

*Regulatory relief and potentially lower taxes we find 25-30% upside to our current 2017e.

- Upside would likely occur over a two year period and represents a very bullish scenario in our view (and assumes GDP growth of 3%-plus over two years).

*This 25-30% potential lift to earnings over a two year period compares to a 16% move in stocks since the start of last week.

Leverage from a stronger economy could boost EPS by ~15%

Stronger loan growth and fees would likely go with a stronger economy. We show leverage to a 10% rise in each, with EPS upside similar for both.

Leverage from higher interest rates could boost EPS by ~7%

Using 3Q 10Qs, we estimate that a +100bps increase in rates would increase 2017e by 6-7% for the large regionals and money centers.

"Leverage from less regulation is tough to quantify given potential upside to both revenues and expenses. The EPS lift from a 1% drop in costs (from likely lower compliance/regulatory costs) is worth about 2%. However, our bias is it could result in a several percentage drop in costs over time. The revenue lift is likely at least partially captured in our stronger loan and fee growth assumptions.

Leverage from corporate tax reform is still too early to tell, but banks seem likely to benefit nicely given high effective tax rates (of 30% on average)."

Assuming a 5% reduction in the tax rate would boost EPS by 7%. Separately, both BAC ($19b, as of 6/30) and C ($45b) have large deferred tax assets that may need to be written down.

There are risks. If growth picks up too quickly, there could be a surprise large move higher in market rates and much more aggressive tightening of monetary policy. The dollar would continue to strengthen and put further pressure on overseas profits(See Ben's note from Monday). Also, certain emerging markets could experience disruption (creating a negative feedback loop) if the US economy strengthens, interest rates rise and the dollar moves materially higher. Lastly, despite a Republican sweep, it’s unclear how easy it will be to pass meaningful policy changes (for example, if pro growth efforts increase the deficit, etc).

Repatriation.

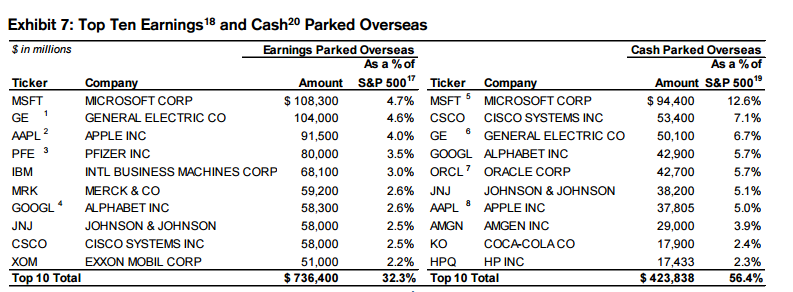

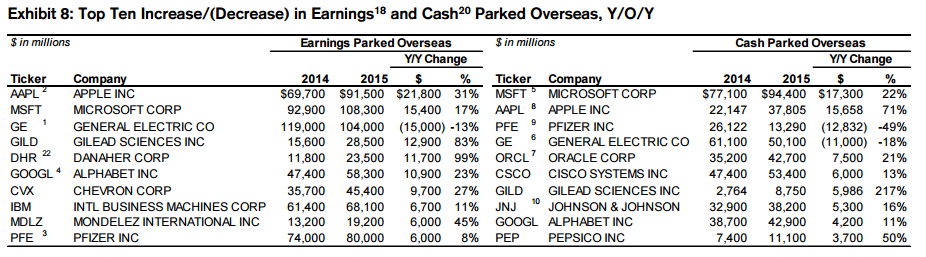

According to Credit Suisse, as of Summer 2016, total US corporate cash hoards held overseas is more than $3Trillion USD. The compound annual growth rate of earnings parked overseas was 18% between 2005 and 2015.- (Source ValueWalk)

Trump has made it clear that reform of the US corporate tax code is very high on his agenda. A potential change in repatriation policy could have material market implications.

There could be as much as $1Trillion USD offshore that is waiting to come home!!

There are likely material implications for both the dollar and particularly the cost of dollar funding. In the event the tax reform is permanent, it is the absence of a future pool of reliable dollar liquidity for European and other foreign banks that will likely have the biggest impact in particular(USD squeeze anyone?).

There are different forms of "offshore corporate cash". Thus, it is important to distinguish between unrepatriated earnings and cash. Per Deutsche Bank: "A substantial portion of US profits are re-invested into foreign operations and capital expenditure and are therefore very sticky. Cash and liquid assets are a subset of unrepatriated earnings and are the most relevant metric to look at: it is this pool of dormant savings that is the most likely to be brought back to the US in the event of a change in tax treatment."

They continue..."How big are the numbers? The upper bound can be calculated by looking at re-invested earnings from the US national accounts. Cumulative re-invested earnings since 1999 currently stand at more than $3 trillion according to the BEA. The number is not reflective of the amounts that can be brought back however. A bottom up analysis of S&P 500 companies estimates that the total amount of liquid assets held offshore is closer to $1 trillion. We would consider this as a reasonable lower bound given that S&P 500 reporting companies only account for a portion of US total market capitalization but include the vast majority of US listed multinationals. The number is also broadly consistent in order of magnitude with the "currency and deposits" item on the US international investment position, currently about $1.7 Trillion"

It is likely that most of these assets already reside in USD holdings. Apple's balance sheet states that its' foreign subsidiary cash is "generally based in US dollar-denominated holdings" but doesn't give a figure.

Data on the location of foreign unrepatriated cash is also hard to come by but the vast majority is located in the Eurozone, followed by the UK, with most profits held in the Netherlands, Ireland and Luxembourg.

The market implications depend on the US corporate tax reform. Positive for the dollar and negative for dollar funding.

The closest parallel to the impact of corporate tax repatriation is the 2005 US Homeland Investment Act (HIA). This temporarily allowed companies to bring back foreign profits at a 5.25% tax rate. US FDI spiked during that year and the dollar rallied by 7%. A number of lessons can be learned from that episode. First, a temporary tax holiday is likely to have a more material upfront impact as it would force repatriation within a shorter time frame. A permanent change would lessen the immediate impact but is likely to be bigger medium-term as it would apply to future earnings as well. Second, the tax rate applied to foreign earnings matters. The lower this is the bigger the likely repatriation.

The broader context and market narrative matters: a number of positive dollar stories took place in 2005, inclusive of a Fed hiking cycle.

We see a corporate tax reform as having a material impact on both the dollar and the cost of dollar funding.

Back to the Dollar: The indirect impact on the dollar is just as important as the direct "conversion" impact. With 90% of profits already held in the greenback we are left with an (upper bound) estimate of 100bn dollars that may need to be converted. Even if much smaller than the headline reported and even if a smaller portion is converted, this amount is material compared to an annual US current account deficit of $500bn. More importantly, the second-order effect may be even greater. A profit repatriation that boosts business confidence and is deployed into capital spending will be positive for the dollar via higher growth and Fed expectations.

Tighter funding, wider cross-currency basis. Even if foreign profits are held in dollars, the impact on the cost of offshore dollar funding can be material if a repatriation shifts liquidity away from European and other foreign banks to the US. The implication is that cross-currency dollar basis would be pushed wider. Our bottom-up analysis suggests that about 250bn dollars currently sit in cash or near-cash dollar liquidity that has the potential to be moved back to the US. Compared to the approximately 200bn withdrawal of dollar liquidity from Eurozone and Japanese prime money market issuers following recent US reforms the amounts are material. Most importantly, this is likely a lower bound on the potential liquidity impact. While corporate may be able to shift the custodial location of Treasury holdings onshore without pulling liquidity from offshore banking systems, it is not clear this can be achieved for asset manager mandates or holdings of non-US resident issuers such as Eurodollar corporate bonds. In the event that the corporate tax reform is permanent, it is likely the absence of future dollar liquidity from US corporate profits will have the most material medium-term impact: approximately 300bn of US earnings are re-invested each year, and the shift of parts of this flow of reliable dollar liquidity to the US would be a negative supply shock for offshore dollar funding.

S&P EARNINGS: Could De-Regulation + Tax cuts + Repatriation + Infrastructure spend while we are seeing a cyclical uptick = much higher S&P earnings? It appears so....

Let's take a peak at the level of Infrastructure spending as a % of GDP that the US has expended. Clearly, we have all experienced the many shoddy airports and roads in our US travels. If the new administration moves forward on the infrastructure spending program, it could have a large impact on earnings. It also would likely have relatively significant bi-partisan support, as this is being proposed by a Republican administration but generally lives within the platform of the Democrats.

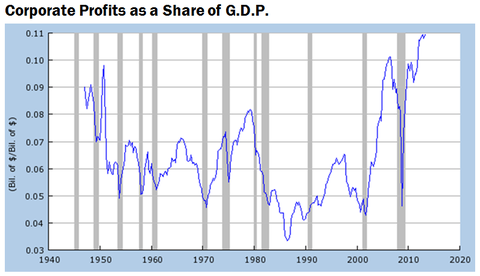

After two years of no material earnings growth in the S&P this could be just the tonic to push forth an acceleration. For Q3 2016, the blended earnings growth rate for the S&P 500 is 3.0%. The third quarter is the first time the index has seen year-over-year growth in earnings since Q1 2015 (0.5%).

YOY earnings growth could accelerate to approximately 8% by 2018. Thus the current valuation begins to look a bit less demanding at 16.5x 2017 estimates.

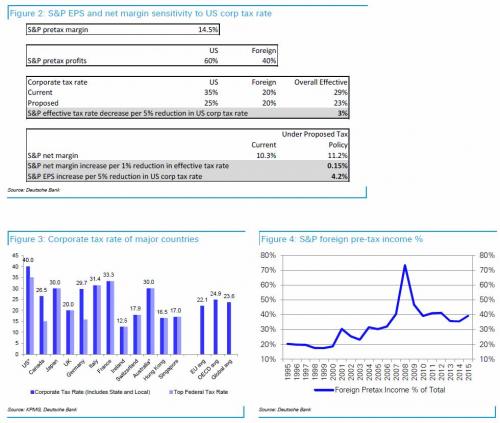

Current Street estimates for the S&P are above $130 for 2017. Per DB ... "Every 5 point cut in the US corporate tax rate from 35% boosts S&P EPS by $5." Thus with only tax cuts the we can get to $140/share. At 17x EPS that could get the S&P to 2400. Some analysts are calling for an S&P500 EPS of as high as $150.00 in 2018!

Per DB..."We’re unsure how much the US corporate tax rate will be cut, but we think a significant cut is likely, and we see ~25% as most likely because it aligns with the OECD avg., it shouldn’t raise the deficit more than 0.75% of GDP, it significantly reduces repatriation taxes and it provides small businesses that want to reinvest their profits for growth a more tax efficient alternative than pass trough entities generally taxed at higher individual rates; this alternative would be especially attractive if the C class dividend tax rate is not over 15%. We’re unsure what happens with personal income taxes, but we don’t see cutting the top marginal income tax rate as the top near-term priority if C class treatment can be made more attractive to small businesses. Every 5pt cut in the US corporate tax rate from 35% boosts S&P EPS by $5. Assuming that the US adopts a new corporate tax rate between 20-30%, we expect S&P EPS of $130-140 in 2017 and $140-150 in 2018. We raise our 2017E S&P EPS to $130."

Clearly the most profitable companies will benefit the most from the tax cuts. That certainly will be a boon to the Technology sector as their businesses generally carry very high profit margins. Companies that pay very low effective tax rates on their foreign profits will have less to gain if a lower US corporate tax rate is the tax policy change used to encourage repatriation of offshore cash rather than a special repatriation holiday tax rate. If a company pays a 0% tax rate on foreign profits then they would need to pay the full (albeit lower) US statutory rate to repatriate profits. These companies would prefer a low special tax rate repatriation holiday or a move to a US territorial system. Thus, what Trump proposes is good for multinationals, but best for domestic companies with high tax rates.

(shaded areas indicate recession years in the US)

Source Federal Reserve Bank of St Louis

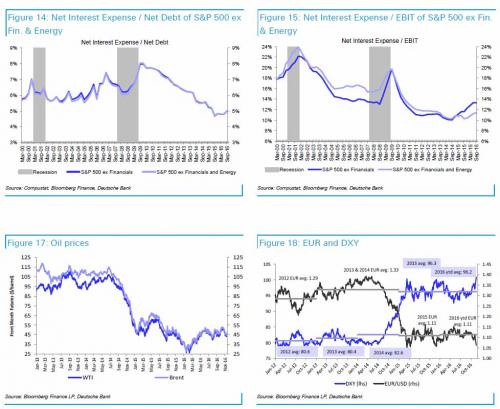

Interest rates have lots of room to climb before threatening PE targets: If you are comfortable with the 17-18 trailing PE that a 2350 S&P target for 2017 end and 2500 in 2018 imply, provided 10yr yields don’t exceed 3% in 2017 or 3.5% in 2018.

Consensus views are emerging of over-weights on big Banks and Health Care and see upside at Tech, Consumer Discretionary and Utilities, but valuations too demanding at Energy, most Industrials & Materials. Staples have FX risk. The pace of the climb in yields is as important as the level. An overly rapid jump in yields could shock real estate and fixed income and weigh on growth. However, this is why Congress will try to find the right balance in its fiscal package and why we think it important that the Fed hike at a moderate pace to prevent the labor market from overheating and to slow the ascent in long-term yields.

Both our partners at Gavekal research as well as DB believe that 10yr investment grade bond yields would need to be approximately 4.5%, and 10yr Treasury yields exceed 3.5%, before companies would face higher borrowing rate than what’s currently in place and thus hurt S&P EPS.

Utilities benefit from: 1) a lower US corp tax rate given nearly 100% US profits and thus no FX risk, 2) likely continued 15% tax rate on dividends vs. income tax rates for interest income and the 3.8% ACA tax is likely dropped, 3) more Federal infrastructure grants and loans for transmission upgrades, 4) a safe haven for retirees and institutions looking to reduce fixed income exposure. You could see corporate sponsored pension plans reduce their equity allocation in favor of long duration IG corporate bonds, but public sponsored pensions and retirees will still likely seek reliable real yield bond substitutes like Utilities.

Finally, the protectionism topic will continue to need to be watched closely. Is this rhetoric and negotiating or is it more than that. Trump has already said he will pull out of TPP. Interestingly Pena Nieto, the President of Mexico has said that he will step forward to "modernize" NAFTA. Apple has said they are considering on-shoring again and Ford has pushed out a plant they were considering moving to Mexico. So, thus far the rhetoric, is helping. We have already seen benefit. Let's watch this though, to see if it becomes more than that and gets competitive.

Either way, some sectors do well during an enviornment such as this, in particular US small caps. We are seeing the commensurate powerful rally in that area beginning after several years of underperformance.

More to come....

Comments