As Q3 Earnings season winds down, we provide a quick update on how the various sectors fared on Sales and EPS results.

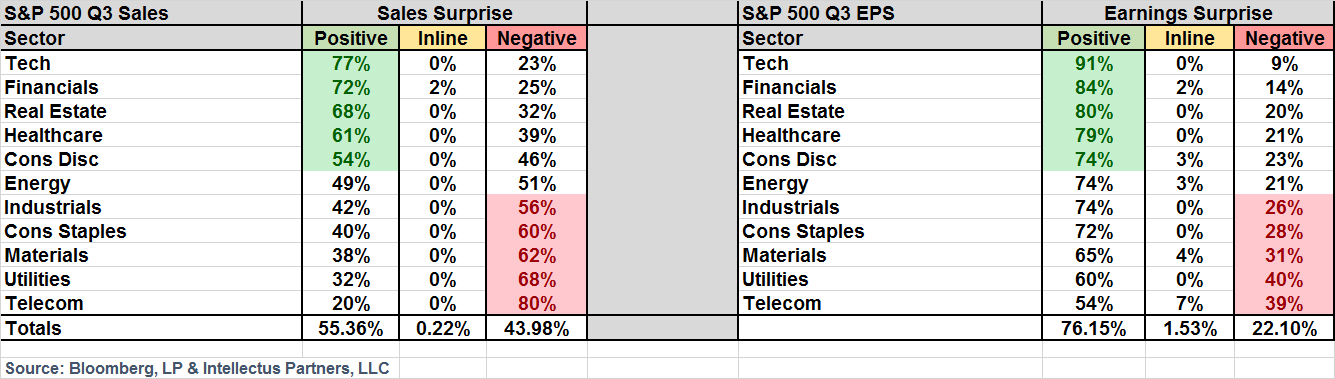

91% of S&P 500 companies have already reported, so at this point we have a pretty good indication of how things are going to settle out. Overall, the quarter was pretty impressive with 55% of companies beating Sales estimates and 76% of companies beating Earnings estimates. The standouts on both Sales and Earnings were Technology and Financials, with 91% of Tech companies beating Earnings estimates and 84% of Financials beating Earnings estimates. The laggards were Telecom Services and Materials on both Sales and Earnings. See below a table which ranks the sectors from best to worst on both Sales (left) and Earnings (right):

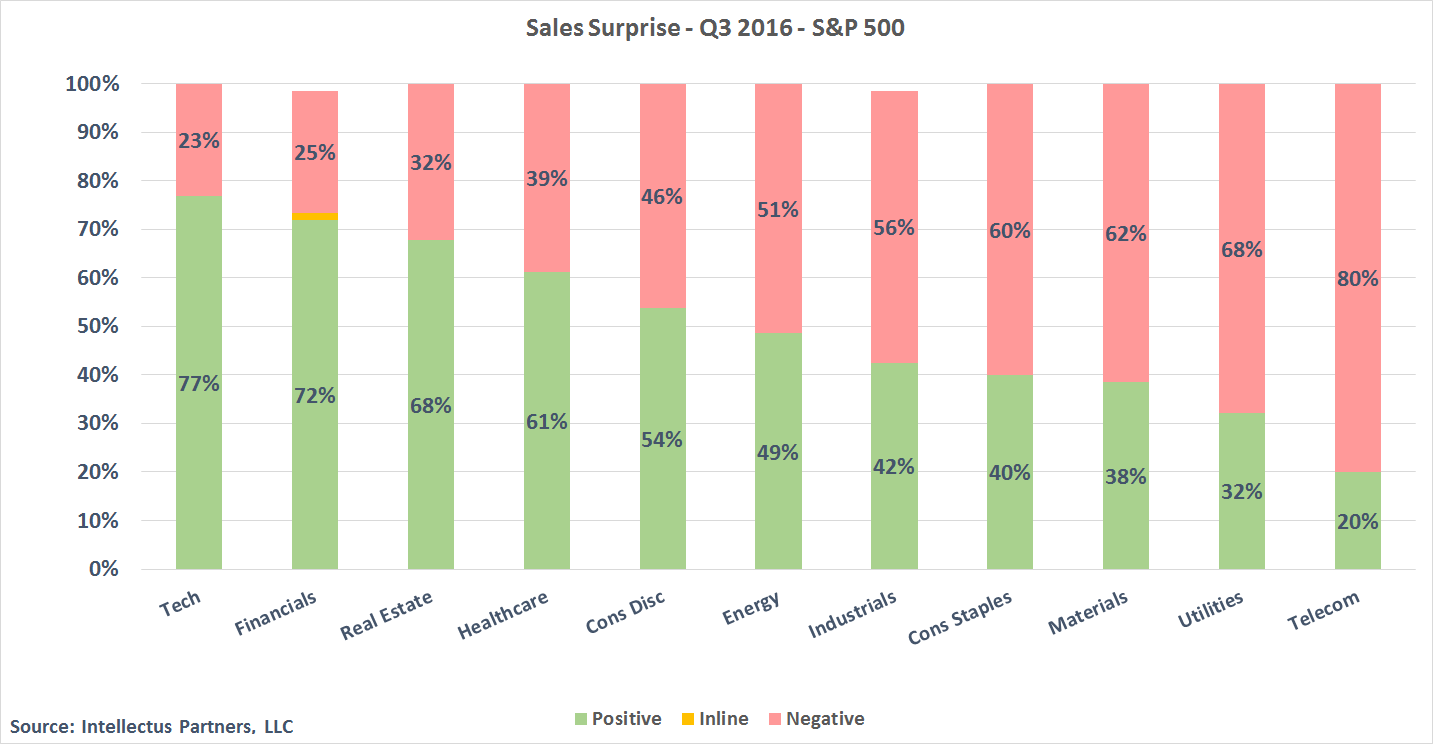

See below a graphical view of the Sales results by Sector, again ranked from best to worst. Technology, Financials, Real Estate & Healthcare look really good from a Sales perspective. Financials, as we have posted on recently, have had an impressive rally on the heels of the election results, and generally do well as the Yield Curve steepens & investors expect regulations to ease going forward. Healthcare also experienced a relief rally on the election results, as investors had priced in a negative environment for Healthcare companies if the Democrats had won the election. If the yield curve does continue to steepen, this would be a headwind for duration assets, including the Utilities and Real Estate sectors.

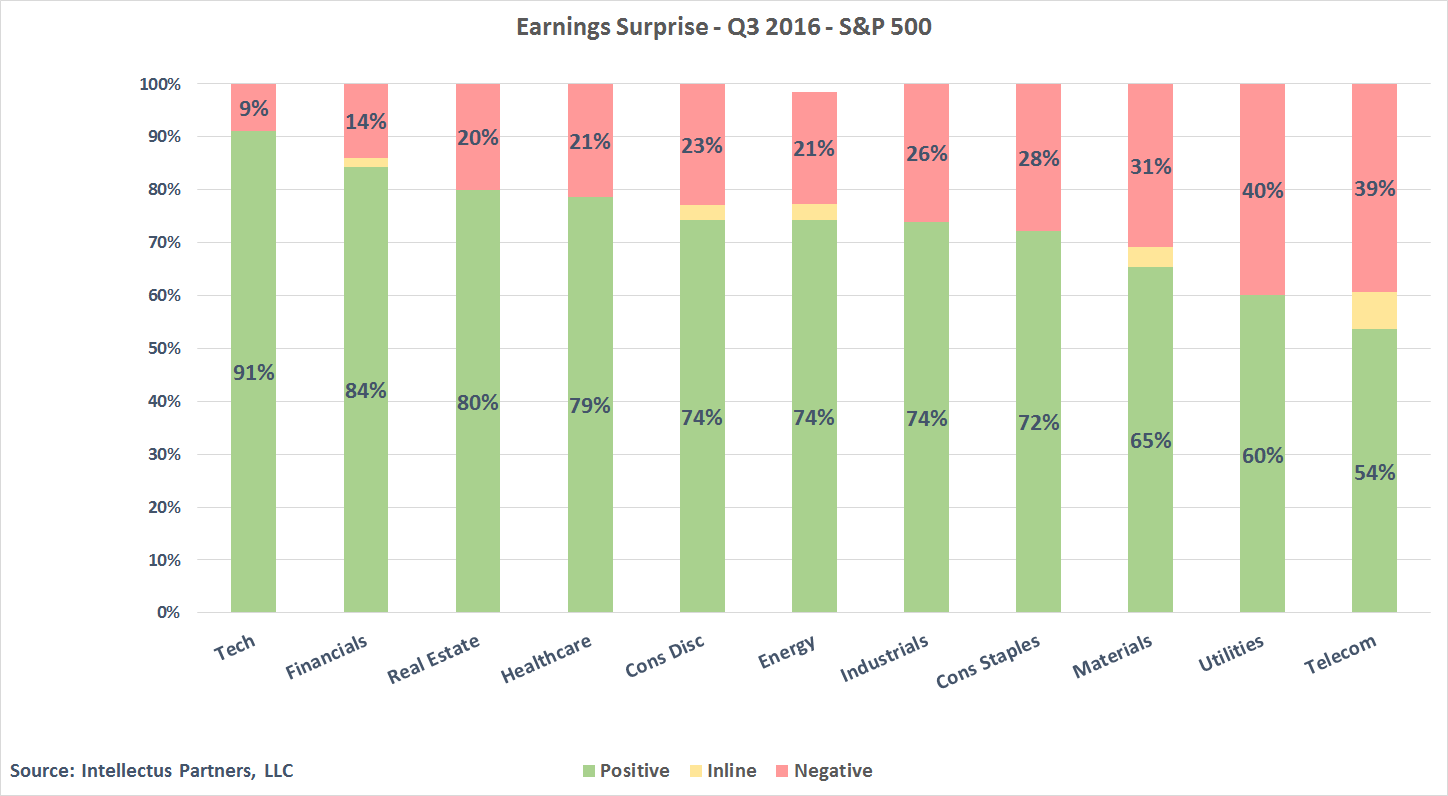

On the earnings side, the story was pretty similar, in that Technology & Financials were the leading sectors with ~ 90% of companies beating earnings estimates in those sectors. Real Estate & Telecom looked notably weaker on an earnings basis as nearly 40% of companies in those sectors missed earnings estimates.

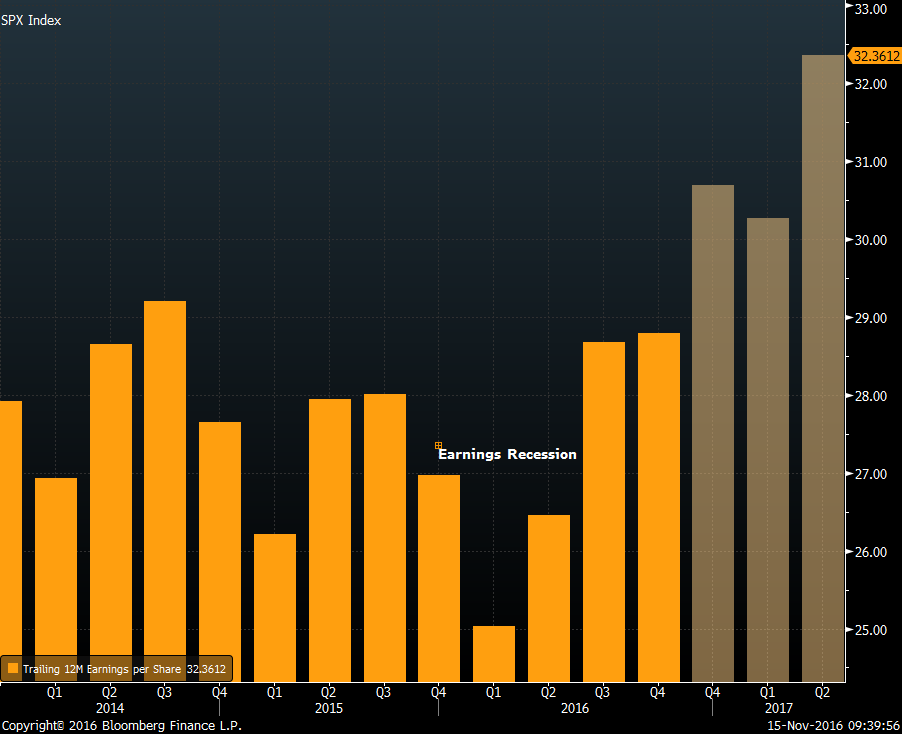

Looking at the bigger picture, the main question would be "Is the Earnings Recession behind us?" Looking at overall S&P 500 earnings over the past few years, you will notice that the S&P entered an earnings recession in late 2015 / early 2016. We seem to have pulled out of this trough for now, so the direction and trend is good. We don't put too much faith in the street estimates for EPS going forward, so we will be watching this closely, along with the high-frequency macro datapoints in order to give us a clearer signal for the medium-term market direction.

Comments