We are big fans of using all tools available to derive insights for our investment views. In particular, alternative datasets are increasingly valuable, available and differentiated.

The advent of Artificial Intelligence on the Investment court has changed how things are done quite a bit. The various A.I. techniques are finding their way into the top trading and research desks of investment managers and advisors. From Natural Language Processing(NLP), to Machine Vision, Deep Learning and others, we are processing mass quantities of complex data via algorithms to better understand (and hopefully predict) our world.

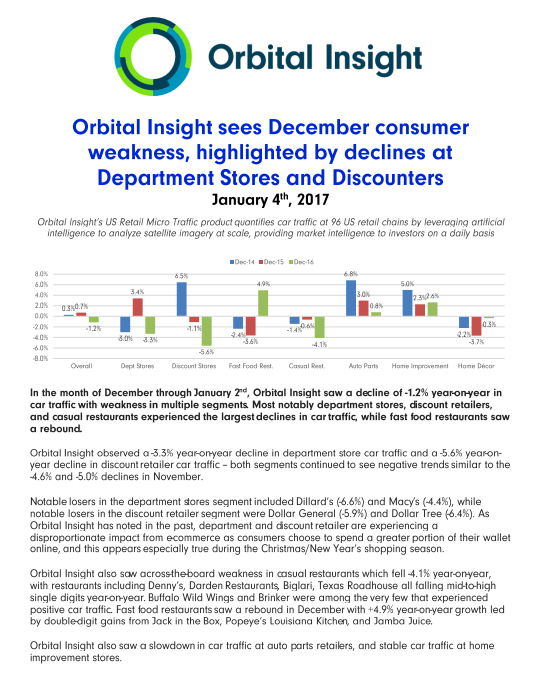

In light of our view of the immense value of these alternative data sets and the high growth companies that are creating this market, We thought that we would share an interesting note that was posted today by Orbital Insight.

Orbital Insight is the leading Geospatial data analytics company in the world. The company utilizes Artificial Intelligence, specifically Machine(computer) Vision and Deep Learning techniques along with other technologies to derive economic insights from imagery-mostly Satellite and UAV based imagery. It is essentially a "Macroscope" for observing the world.

Today's note by Orbital is particularly interesting in light of the market strength, the increasing Consumer Confidence and optimism of late. Does this view below bode ill for retailers? Does this imply something about the strength of the economy or is another piece of evidence of the "Amazon effect"? We shall see....

Full disclosure, Orbital is a close partner of Intellectus as we are an investor in the company and sit on the Board of Directors, as I have since inception.

If this topic of new technology on Wall Street and Investing, is of interest to you, let us know as we would love to talk data and tech with you.

Reprinted with authorization of Orbital Insight, inc., www.orbitalinsight.com

Comments