Just as the Brexit outcome in the United Kingdom had very significant affects on global markets, I view real risk of a similar type of event happening in the United States with our Presidential election on Tuesday, November 8.

Going into the vote in the UK, the world was sanguine about the chances of the British Citizenry actually voting for a "Leave". The punditry that nary has an independent thought and so often just writes what they are told, assured the world that the vote would be a non event. Even global betting markets had the odds skewed as if it were a sure thing that the British citizens would never be so dumb as to vote to leave. The scare mongering and independence bashing was everywhere and funded by some very powerful organizations and supporters.

As we now know, Brexit happened. It led to fireworks in world markets. But those fireworks were rather short lived. What followed economically , thus far, is what one might expect. There has been disruption economically. There are companies large and small reconsidering their exposure to the UK. The EU immediately began negotiating. Clearly, the EU was and is afraid of others following suit. The Sterling resumed it's downtrend and has not stopped. It currently stands at 1.21/USD from the 1.50 it traded pre-Brexit. Not surprising to us, UK stock markets have been among the best performing equity markets in the World since Brexit.

Now it may be our turn here in the US. In many ways, the "setup" is similar. overconfident odds makers, forward leaning markets, Powerful campaigns driving messages to influence and a battle between "elites and the average citizen". We are enduring one of the most grueling, vitriolic and angry election cycle in many generations. The reasons why this is occuring are many and not for this medium. The fact remains that we are indeed here.

The markets are still expecting one outcome, a Clinton victory. What if the markets are wrong? This election will affect our Republic and for our purposes, our economy and markets in profound ways. I am not interested in predicting the outcome of the election itself. But, the affects of the low odd/high skew outcome and the likely reaction of markets to it are of intense interest.

Let's start with some facts:

1.According to the Las vegas odds makers, there is still a 4:1 odds that Clinton will win the White House.

-

Nate Silver still has about a 75% chance that Clinton will win. http://projects.fivethirtyeight.com/2016-election-forecast/?ex_cid=rrpromo#plus

-

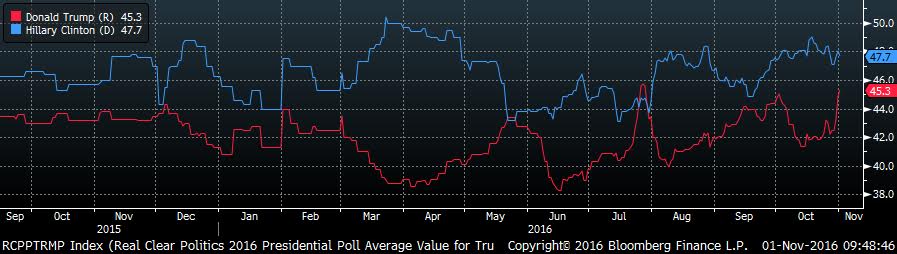

The polls are tight. As of today, ABC/Washington Post has it within the margin of error with a miniscule Trump(+1) lead. The graph below is the Real Clear Politics poll, which still has Clinton in the lead, but it is interesting, that this is the highest he has polled in their polling.

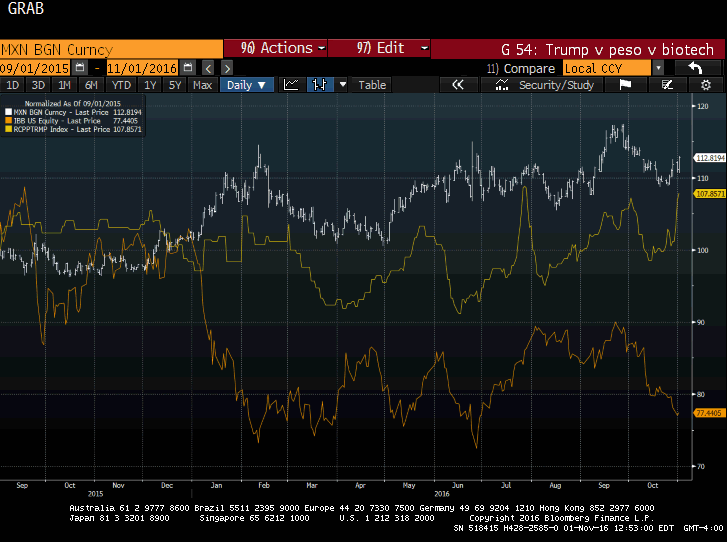

Additionally, we ran some correlation graphs of the Real Clear Politics Trump polling average vs the Mexican Peso and also the IBB Biotech ETF. Not surprisingly, there is a very tight trading alignment between the Peso (white line) and Trumps poll (Yellow) movement. There is also a relatively tight relationship with Biotech(orange) a likely beneficiary of a Clinton loss . Clearly, the recent Wikileaks and announcement by the FBI Director to re-open the Clinton email investigation are having real affects.

4.The public and the markets are not overly bullish in sentiment or behavior. In my view, there is quite a significant bit of "fear" that Trump will win (just as there was a comparable fear of the unknown ahead of Brexit). The below graph is the AAII Bull poll is not overly pessimistic, but it is stuck in the lower range and this is generally a supportive concept. It is interesting that this lack of enthusiasm has been chronic for the past 9 months(election fatigue?)

The amount of cash (cushion) in portfolios is already above that seen during both Europe's sovereign-debt crisis and the U.S. debt-ceiling debacle, according to Bank of America Merrill Lynch's monthly survey of money managers. Keep in mind that this is before any news of the election.

5.The bottom line is that a Clinton Victory is overwhelmingly expected by the financial markets. With Clinton in the White House we are likely to maintain the status quo of much of todays policies.

But,there are many important macro-economic considerations from an unexpected result in the election. In the interest of time, today we will focus this blog on one primary area, that is Trade:

A. The Federal Reserve: (Change) Trump has stated that he is no fan of Janet Yellen and the current FED positioning.

B. Obamacare: (Change)The controversy here is inescapable. It is apparent that a change in leadership would create significant changes here.

C. Fiscal Policy: (Change) Specifically, we think Fiscal policy makes a comeback. Mostly because Monetary Policy has largely run it's full course and is no longer having a positive impact.

D. Inflation outlook: (Unkown)This is key. As the FED has stated, we clearly need to see some inflation. In fact, we are seeing sustainable wage inflation settling in.

E. Immigration: (Change) Cleary, another vital issue. The demographics of the US have been supported significantly by the influx of immigration. This influx of low cost wage earners has certainly kept a lid on wage costs.

But most important to us is Free Trade:

F. Trade : In my view, this is the big one. It is unfortunate but it seems apparent that "free trade" as we have come to know it has run into a brick wall. The evidence of it is everywhere. The "fall of Wall Street" as an aspirational goal of young, smart college students is a good place to start. Another example is the surprising rise of a politician such as Bernie Sanders. Who would have believed in 1999 that in just one generation, there would be a "movement" to elect a "Socialist" as President of the United States of America and the the standard bearer for what the US represents? Frankly amazing. Taxes are no longer viewed as punative and anti growth. Government itself has taken on a luster of benificience. The fact that the second largest economy in the world is communist, yet another. The point of this is that, outside of the elites, the average citizen(in America and outside) are just not so sure of "free Trade" anymore. But the elite's cannot understand. The Wealth gap that has surged in recent decades is at an unsustainable level. Consequences will surely follow. It appears that the consequences are upon us and it may just be felt at the voting booth.

So, Wall Street is afraid of Trump for several reasons. In my view, the primary reason is his position on Trade. He has pronounced policy initiatives that would possibly change our position in the world vis a vie Free Trade and it looks to the elites as protectionism. To them, protectionism is always bad. That may be true, and it certainly is the view of most economists and the common understanding of growth. Fewer barriers to trade simply can only mean more trade!? But, we forget that in most Presidential elections this item of protecting "workers" wins votes. It tends to win over a certain part of the electorate. It also tends to only be enacted in small doses. In fact, many forget that President Obama railed against bad trade policy while he was running, and then instituted a 35% tariff on foreign tires once elected. We are not one to argue for tariffs let alone against free trade. So, the question is just how far this idea of protectionism would go?

Free trade is a must for our prosperity. But broadly speaking the largest beneficiary is capital and the least to benefit is labor as prices improve but wages are suppressed. Especially lower wage jobs. This can exacerbate the winners and losers in an economy and accelerate the Wealth gap. The quality of trade deals must improve. But, the truth appears that recent trade deals have increased exports at a greater rate than imports, improved the balance of goods trade for 13 of 17 countries, turned previous goods deficits into surpluses, and have added a net improvement of $30.2 billion annually in our trade balance on goods alone. The fact that these figures omit our trade in services—America’s strength—significantly understates the powerful positive effect these agreements have had across the board.

But, let's just look at the "elephant in the room", the Great Depression as an example. In fact, given what the US and World economy have suffered through since the Great recession, it is pertinent to review.

A common argument as a cause of the Great Depression is widely considered to have been the restrictive Trade policies that were enacted. Specifically, there is the compelling view that Smoot-Hawley, which was enacted in 1930 was the cause as it increased tariffs. But this is debateable, and may be just plain incorrect.

According to Ian Fletcher, the author of Free Trade Doesn’t Work: What Should Replace It and Why, An Adjunct Fellow at the San Francisco office of the U.S. Business and Industry Council, It was not the cause of the Depression but it was the FED itself, who , after causing a bubble around the world in the late 20's crashed the party via Monetary policy. The Fed allowed money supply to contract by 1/3.

"The answer can be ascertained by looking at Smoot-Hawley’s impact on the world economy at large. As the economic historian (and free trader) William Bernstein puts it in his book A Splendid Exchange: How Trade Shaped the World,

Between 1929 and 1932, real GDP fell 17 percent worldwide, and by 26 percent in the United States, but most economic historians now believe that only a miniscule part of that huge loss of both world GDP and the United States’ GDP can be ascribed to the tariff wars. .. At the time of Smoot-Hawley’s passage, trade volume accounted for only about 9 percent of world economic output. Had all international trade been eliminated, and had no domestic use for the previously exported goods been found, world GDP would have fallen by the same amount — 9 percent. Between 1930 and 1933, worldwide trade volume fell off by one-third to one-half. Depending on how the falloff is measured, this computes to 3 to 5 percent of world GDP, and these losses were partially made up by more expensive domestic goods. Thus, the damage done could not possibly have exceeded 1 or 2 percent of world GDP — nowhere near the 17 percent falloff seen during the Great Depression... The inescapable conclusion: contrary to public perception, Smoot-Hawley did not cause, or even significantly deepen, the Great Depression.

The oft-bandied idea that Smoot-Hawley started a global trade war of endless cycles of tit-for-tat retaliation is also mythical. According to the official State Department report on this very question in 1931:Department report on this very question in 1931:

With the exception of discriminations in France, the extent of discrimination against American commerce is very slight...By far the largest number of countries do not discriminate against the commerce of the United States in any way. That is to say, foreign nations did indeed raise their tariffs after the passage of Smoot, but this was a broad-brush response to the Depression itself, aimed at all other foreign nations without distinction, not a retaliation against the U.S. for its own tariff. The doom-loop of spiraling tit-for-tat retaliation between trading partners that paralyses free traders with fear today simply did not happen."

Now let's ask the greatest economist of all time, Mr Milton Friedman? Obviously he was one of the strongest proponents of free trade. But, even he looked elsewhere for the cause of the Great Depression. He clearly explains his view in an interesting 7 minute explanation:

https://www.youtube.com/watch?v=ObiIp8TKaLs

So, what does this argue? It says that Brexit is considered protectionist. It says that a Trump victory will drive some additional protectionist policies. We have been told that it could cause a severe financial shock. But, what if that is not true? What if Brexit in fact instead brings freedom and control back to Britain, and Brexit 2.0 free and fairer trade policies with less government and regulation?

So, what to expect if the low odd event- a Trump win, happens? It is my view is that it will change quite a bit thematically, it is likely to influence sectors differently and outcomes. Just as President Bill Clinton was the beneficiary of a massive technological wave (that being the advent of the internet) to boost his economic bona fides, we just may be entering a new phase of similar dynamics. The sea change that is beginning to uproot American Industry via Artificial Intelligence will go undaunted. The incredible innovations in healthcare and biotechnology and personalized medicine will only continue. The new privatization of Space is just in the first inning. The current massive ongoing disruption in industrial technology ,automation, transportation and energy will go on. And the strength of the US will be undaunted for many years as our consumer will always be the primary customer for multi national companies.

It is clear to me though, that the primary drivers of opportunity will not immediately end, they will change- as they always do.

I do expect near term volatility. I do think the markets are overly sanguine about a Clinton victory, and have not taken seriously the very real possibility that the "undesired" event could occur. I also think that the markets have leaned aggressively in that direction. I am saying that we think investors should be prepared for a low odds, but high skew event such as a Trump victory. The equity markets are not going to like it and will have a period of volatility. We are also saying, that if that happens, the US, our economy and innovation will continue moving forward.

...and if I am wrong, we will have more of the same....

Comments