In her recent speech, Federal Reserve Chair Yellen introduced a phrase that may determine how markets, economists and the public will think about the global economy going forward. Yellen suggested the Federal Reserve should allow the U.S. economy to turn into a "high pressure economy." That means an economy where labor markets are very tight, demand is robust and capital spending runs at a high rate. For Yellen to arrive at such a conclusion, there were four critical issues she highlighted for future "research:"

-

Hysteresis. The global economy suffers from "supply damage" caused by a sharp fall in aggregate demand due to hysteresis. Developed economies saw in their real estate and financial sectors massive layoff, and supply of highly specialized workers was absorbed insufficiently. Because most of those workers were above median income earners, their spending collapse contributed significantly to the fall in global aggregate demand.

-

Heterogeneity. Because of an upward shift in structural unemployment, household spending bifurcated. To an extent this explains why the collapse in home equity led to a spike in household savings. Since 2009, the savings rate in the U.S. averaged 5%, and in Europe and Asia over 12%, well above pre crisis norms.

-

Financial linkages. Because credit availability interacts with interest rates to affect consumer spending, housing demand and home prices, business investment, and formation of new firms, financial linkage is an important variable that can influence aggregate demand.

-

Inflation dynamics. Determined by an underlying trend and influenced by inflation expectations that depend on monetary policy, inflation fluctuates by other factors like energy and capacity. Inflation expectations on the other hand, form by surveys such as Michigan and Blue Chip or by market based measures like inflation-linked bonds.

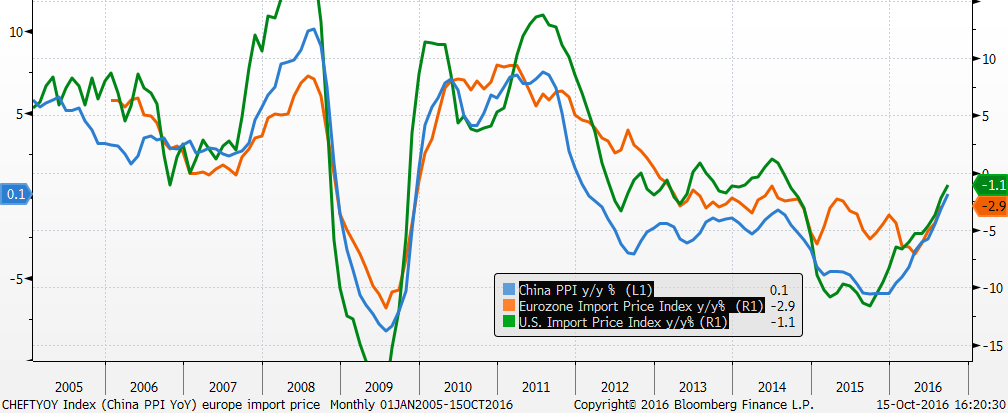

Yellen ended her speech by making a reference to "international linkage." The U.S. economy is no longer a closed economy, and Fed policy impact global financial and economic conditions. To let the U.S. economy run "red hot", it means the global economy has to be in a volcanic state. There are perhaps tentative signs of this such as the reversal PPI deflation in China, the Pound Sterling drop causing U.K. inflation expectations to spike and inflation rates in emerging markets rolling over. Figure 1 shows how for example the Chinese PPI deflation impact import prices in the U.S. and Europe. It appears a reversal of PPI deflation is under way.

Figure 1: The End of China PPI Deflation May End Imported Deflation Globally

Source: Bloomberg, monthly data, 2005-2016

The global economy remains however at risk of "stall speed" because of the four areas Yellen discussed, and a lack of global trade and investment. That being said, the significance of a high pressure economy may set in motion a "reflation effect" helped by a rebalance in commodities markets (OPEC deal in November), tightening of labor markets, currency depreciation in China, trade imbalances increasing, and expansion of fiscal deficits (e.g. U.S. deficit went to -3.2%). Unlike the 1970s "stagflation" caused by a price-wage spiral, today's global economy sees a "StallFlation." For investors, this "StallFlation" means steeper yield curves, higher volatility and rising commodity prices.

Comments