With the recent volatility we wanted to share some of our thoughts on what is happening , and how we think about these types of interruptions of the Bull Market.

Markets are hard to predict, so we do not really spend too much time on predicting them. What we do is look for powerful trends, innovation, great management teams and undervalued companies. Each and every analyst, portfolio manager or trader that interacts with our capital has the same high bar to achieve. Make sure that the capital invested is allocated in the most optimal long term risk adjusted method as possible.

The investments that we own carry a strong combination of accelerating revenue and profit growth along with generally undemanding valuations. The large majority of single names that we own are secular growers with specific growth catalysts likely continuing. These are companies with major trends at their backs, huge Total Addressable Markets and decreasing competitive threats. In addition the portfolios are loaded with positions that are just incredibly cheap relative to their opportunity set.

We are generally very constructive on the portfolio and allocation to our managers, funds and companies that we own. In fact, we are currently of the view that there are more new opportunities that are attractive now than we have seen in a long time. We are very optimistic on the true drivers for this bull market. Just as we saw in the 1990's and the advent of the Internet, today we have an even larger innovation cycle. One led by the confluence of Mobility,the Cloud, AI, 5G, Autonomy, IoT & Edge Computing, New Space Tech, Biotech and Blockchain. Individually these are large, together they are profound.

So, our perspective on the Macro Enviornment is that it is very difficult to time the markets. At this juncture our view is that we are undergoing a correction in a Bull market that currently has the wind at it's back. What is causing this latest bout of volatility? In our opinion, normalcy. In other words, we are still a bit accustomed to the low volatility regime (see below) that we have seen for the last 18 months or so. It is typical in ongoing Bull markets which we still believe that we are in, to see at least 2- 5 or 6% corrections during each year and on average one 10%+ correction annually. This year we had the first in January/February. In that period, even leading names that proceeded to trade meaningfully higher afterwards had large corrections including AMZN(-17%),Google(18%),Disney(14%),Honeywell(13%), the Russell 2000 (13%) and Value Line(11.5%). So, this kind of action is not uncommon.

Now, volatility has made another sudden snap back. As you see below, the VIX index hit a high near 30 this past week. Since this Bull market began we have only seen a few periods with Volatility meaningfully higher. Generally these levels signal opportunities in markets. It is, however difficult to predict the exact level that markets will stabilize. In this case, we think there is still some room for continued volatility and the correction to run.

The excuse in the January/February correction was two-fold. One was that the positive effects of the recently enacted Corporate tax cuts, repatriation and regulatory cuts would not materialize. The second was a spike in interest rates. As it turned out, earnings did materialize…in a big way in fact! That is why S&P earnings expectations surged following that correction from $145 to about $160/share. So, of course stocks followed. Now, in spite of the January/February fears of overvaluation, we have stocks trading at reasonable valuations (as you will see below). In fact, earnings growth is likely to come in at 24% or more in the US (and surprisingly 20% for the EuroStoxx Index). Even the next couple of years growth is still expected to be above average at about 7% in the US alone.

The US markets trade at 16/17X NTM estimates, Japan’s Nikkei 15X, EuroStoxx at just 13X, and the Chinese Hang Seng at 10x! These clearly are not stretched valuations.

And here is some interesting historical perspective(and why we call stocks not overvalued). If you note in the graphic below, we have included two important metrics, price/Cash Flow and NTM PE. In both cases we are currently below the long term averages of 17.10 PE (today is 16.89 and 23xCash Flow(today at 21). “Cheap” no, but when you put into context the earnings growth that we are seeing, then you have robust opportunities.

Then, if we are NOT worried about valuations, what else could be going wrong?

Well, as we all know, we live in days of utter craziness outside of the markets. The Social and Political Climate are the concern du jour…daily. What is the effect of this? Mostly it is a distraction (and elongating the Bull market). Well, for the last two years the pundits claimed that this would kill off consumer demand, crush hiring plans by corporations and end the Bull Market that started in 2013. Well, clearly that narrative was wrong, very wrong. We have consumer confidence at all time highs, as is employment and a host of other indicators. The economy in the US just posted a remarkable 4% growth in GDP. All of this with the non-stop Trade War angst and relatively strong dollar.

All of these things were supposed to kill the US economy. They didn’t. Now in addition to the earnings evidence, we have some of the first Trade related light at the end of the tunnel. NAFTA was indeed renegotiated into the USMC as its replacement. The tone of the rhetoric with Europe seems to be slightly improving.

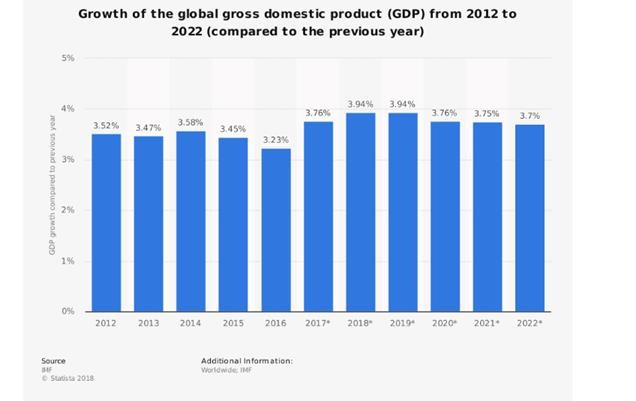

What is left is the 800 pound gorilla, China. This clearly a harder problem to solve and is a major risk. The Trade War narrative is certainly already creating pressure on the China economy and their markets. This is indeed having spillover effects into Emerging markets and other countries that have been reliant upon China. This is something to watch. It is a clear impact to the global economic growth outlook. It has indeed affected global stock markets as the MSCI global has been routed to the tune of 18%(almost making it an “official bear market" of a 20% drop). But keep in mind that thus far, actual global economic growth is surprisingly strong still. At last check it is estimated that Global Growth will clock in at 3.94%(see above) for 2018. An ACCELRATION from 2017 and any year since this Bull Market began. That said, it is important to note that the “Asian Contagion” that occurred in 1998 was a meaningful correction in Emerging markets that led to a meaningful correction in US and Global equites as well. But that was also within the context of a larger Bull market and innovation cycle similar to what we are seeing today.

What about “the next recession”? that seems to be on everyone’s mind these days. It seems logical that the FED will likely be part of the cause of the next recession as they have been complicit in most- if not all previous recessions. That means higher interest rates might just chock off the growth. In fact, in our post on January 2018, we pointed out that there was indeed “regime change” happening and that was going to be reflected by higher interest rates. That has indeed played out as we expected. Our view is that the 30 year bull market in bonds is indeed over. As far as the FED is concerned, though, Chairman Powell has taken a relatively patient path towards tightening. So, that patience is allowing the markets to adjust gradually to the changing regime. But, it appears that the markets may be thinking that higher rates will be the cause of the next recession.

That January correction it was caused initially by rising rates. The US 10 year hit about 3.15. The markets freaked out about that and then it retreated all the way back to 2.85. The ally resumed. But not without the new narrative. That new narrative was that a “flat yield curve” was predicting a recession. Well, first of all the curve never inverted. It got to about +90bops on the 2/10 curve, but NOT INVERTED at all. Now, what do we have as the latest excuse? It is rising rates again. The US 10 year just printed 3.26% a high for the cycle. As if on cue, stocks melted down again. But, wait, what about that inverted curve? Well, the markets forgot about that but went back to fretting about the absolute yield.

Yes, interest rates are competition for equites. High rates could and will take demand away from equities. But at 3.25%? I don’t think so. In fact, During the bull market of the 1990s, bond yields averaged 6%(see graphic above). Today's rates are still among the lowest in history, and only 2 years ago they were the lowest in history. During the "taper tantrum" of 2013, rates got to around this level and people then started to take money out of bond funds and shifted it to equity funds. It is all a function of the growth that comes along with those higher rates. Given that we are currently on pace for nearly 4% global growth with all of these concerns out there, bodes well for how sustainable that growth may be and how high of rates the economy can withstand.

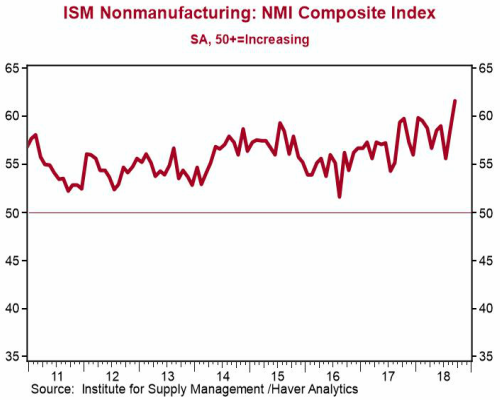

So, how high can rates go and will they cause the next recession? Clearly a lot higher. But not likely without strong economic growth. In fact, the trend in the economic data continues to be robust. As you see in the above graph, a key indicator is the ISM index. The version above is the Non Manufacturing. This clocked in at cycle high (and second highest of all time) of 61.6! The internals were just as strong, as new orders and business activity hit near all time highs as well. Even with that kind of robust data, inflation is still checking in a just about or below that 2% threshold.

What will the market be willing to pay for a return stream of 10 yr bonds that does not grow? Today, it is about 30x and that seems like it creates some bit of a cap on how high rates can go, or at least how quickly they can get there. As long as inflation stays contained, then it is likely not rates alone which kills this bull.

Comments