Last Friday's (May 5) payrolls report was a steady as you go report. The consistent strength in payroll growth suggests "slack" is gradually removed. If there was an acceleration in reduction of slack however, not only wages may rise faster, but productivity would go up too. This hasn't been the case so far with the recent productivity report showing a meager 0.6% annualized increase.

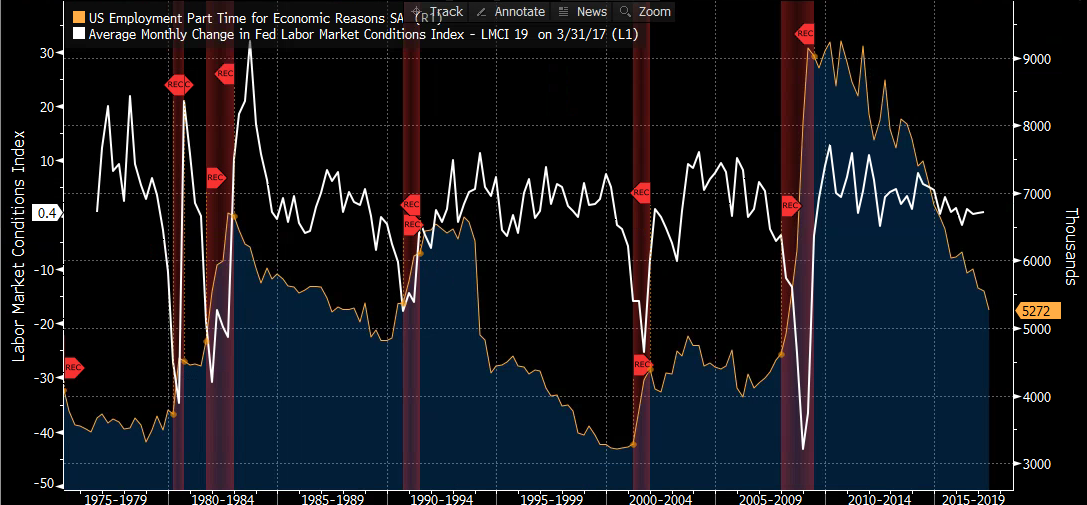

The labor market is therefore currently tightening in a moderate fashion and this coincides with a slow deterioration in the labor market conditions index published by the Federal Reserve. The graph below compares a measure of slack (part time employment for economic reasons) and the labor market conditions index.

The positive change in the labor market conditions index has historically peaked about a year prior to when part-time unemployment reached a (historical) low. At that point labor market slack is more or less fully erased. That point however is also a signal of an impending recession in the year following.

The chart shows we are moving to that point the labor market conditions index has peaked in terms of positive change but it may take another year before all the slack has been removed from the labor market. Bond markets are wary because at the current juncture of decelerated momentum in labor conditions and a falling unemployment rate, a stronger signal of a near term recession may be heard. If that is the case, the stock market will eventually respond too.

Figure 1: Labor market conditions and Payrolls

Comments