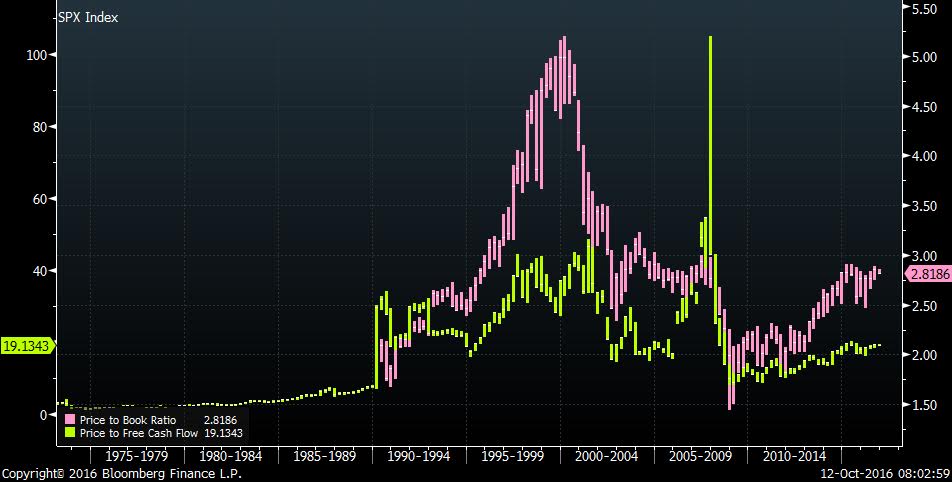

Not that I want to be the one spinning anything in equities at this point as positive, but, if you look at S&P valuations(courtesy bloomberg) based upon two particular metrics, you find that on a price/book AND a price/cash flow(trailing) you do NOT find overvaluation. In fact, if you consider the price/cashflow metric alone, it appears relatively inexpensive.

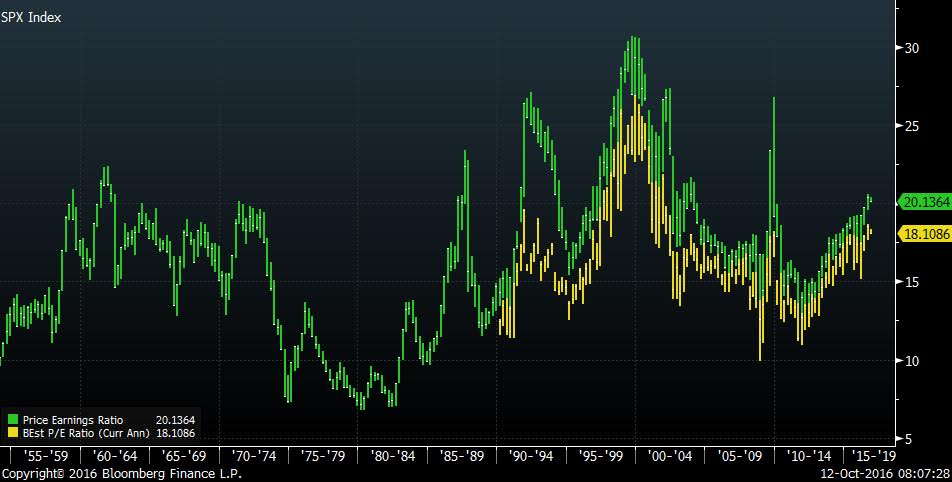

Next, if you look at both trailing PE and estimated PE, the valuation falls into a mid range.

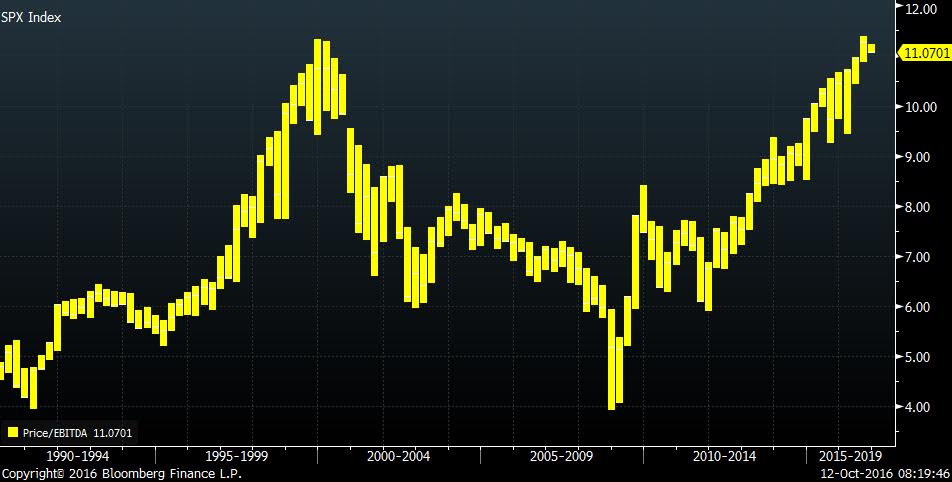

But, this is NOT the case if you look at trailing Price/ebitda. In this case, it shows extreme overvaluation.

One last thought, especially as it relates to the P/Book ratio, this metric seems at odds with the continued profit margin strength.

So , this reminds me of one of the old timer adage's that I was taught early on in my career. The market does not care too much about "good or bad" it really cares about "better or worse". That is especially true when valuations are on the high side as they appear to be today.

Comments