Markets faceoff a crucial week of central bank meetings with the Bank of Japan and the Federal Reserve on Wednesday. As recently doubts grew the BoJ could continue the course, Japanese interest rates rose sharply. When ECB President Draghi said a possible extension of quantitative easing not discussed, global rates experienced a “tantrum”. This phenomenon has become recurring since 2013 when the first “tantrum” appeared. Markets grapple how QE policies could formally end which explain why interest rates react with a tantrum. Underlying the tremors lies a structural issue, and that is whether is there is no longer a “risk free rate.”

The existence of the global financial system rests on two assumptions: a risk free rate and a reserve currency. Since the European sovereign crisis began, the risk free rate status of government debt came in doubt. The European Stability Board issued a special report last year that based on the experience of the debt crisis, zero risk weighting for government bonds should change permanently. That change however may not be as straightforward because financial markets sprinkled with “subsidies.” QE and negative rates are examples of subsidy for governments and so is “too big to fail” for major investment banks.

Other examples of subsidies are explicit guarantees for Fannie and Freddie, dual recourse for covered bonds, a deflation floor on Treasury Inflation Protected Securities, zero interest floor on floating rate securities, tax exemption for municipal bonds, insurance “wrappers” in structured credit deals, and “sweeteners” in sovereign debt restructurings. A securities’ subsidy provides comfort to investors to take on more risk as they can rely on a safety net. If the risk free rate has no existence, subsidies must change.

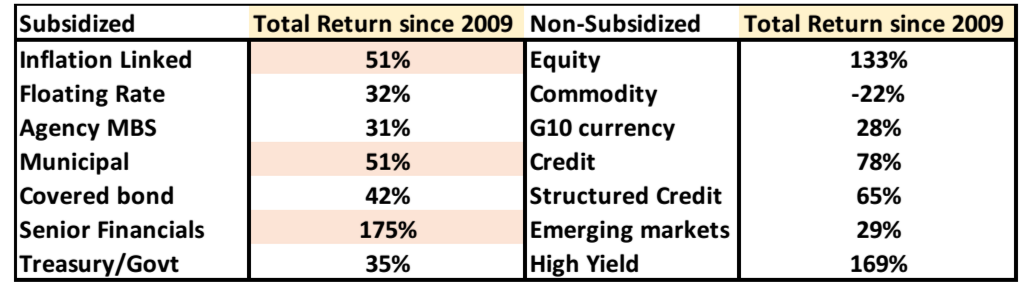

That could happen in two ways. Central banks abandon quantitative easing policies that compounded returns levered by the safety of subsidies. The subsidies change because of regulatory overhaul. In some cases, “subsidized” assets have outperformed “non-subsidized” assets since QE began in 2009. Table 1 shows the results. This data says the “risk free rate of return” of subsidized assets has vulnerability as QE and “too big to fail” may change. The impact could be material because not just assets returns highlighted in light orange (Table 1) would turn negative, there would be a spillover to other asset returns like equities.

Table 1: Index Returns of Subsidized and non-Subsidized Asset Classes

Source: Barclays Indices, Bloomberg

As much as the Bank of Japan meeting has specific aspects, the broad implication is QE transmitted “risk free” globally and leveraged excess returns through innovative products like ETFs, CLOs and index funds. If markets have become truly aware a safety net may be lacking, the ramifications are unforeseen. Investors should remain alert and wary, and continue to keep high liquidity in portfolios. Cash is king sometimes but cash also has no return and can be stolen or lost. Enhanced liquidity through a combination of liquid, limited subsidized assets could be the alternative portfolio.

Comments