We thought that you would find this "white paper" from our long time partners at Polen Capital very interesting.

At Intellectus, we need to manage risk on a daily basis. Risk can mean different things to different people. It comes in different forms and most people react to it very differently. A common perception is that diversification, is the primary and only means of reducing risk. In fact, there is an old Investor adage that says, "You make money through concentration, you keep it via diversification". That is generally true. But like most "adages" there is some truth to it but certainly not a complete understanding of risk.

We are very proud to have been an early supporter of the team at Polen Capital. Our association is going on 15 years and through three of our prior firms.

In this post, Stephen Atkins, CFA pens a compelling rationale for why an Index approach is not always the best approach.

Please note the opinions of the authors provided are not necessarily those of Intellectus Partners. The experts are not employed by Intellectus Partners and their views and opinions are subject to change at any time based on market and other conditions.

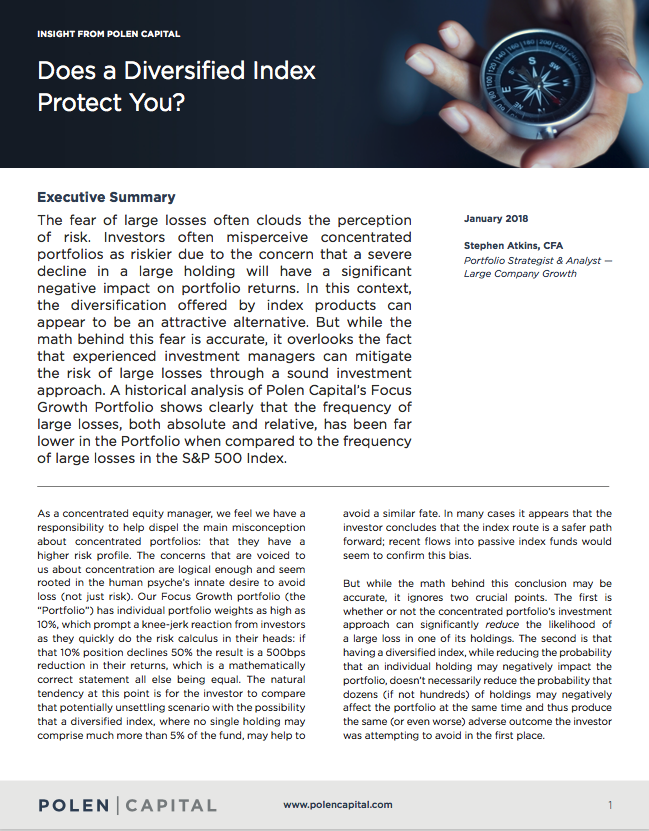

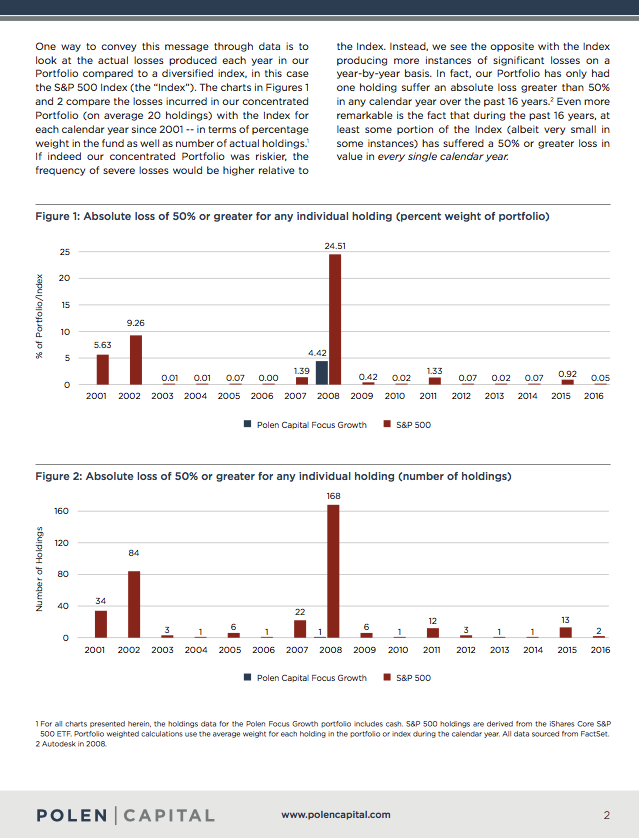

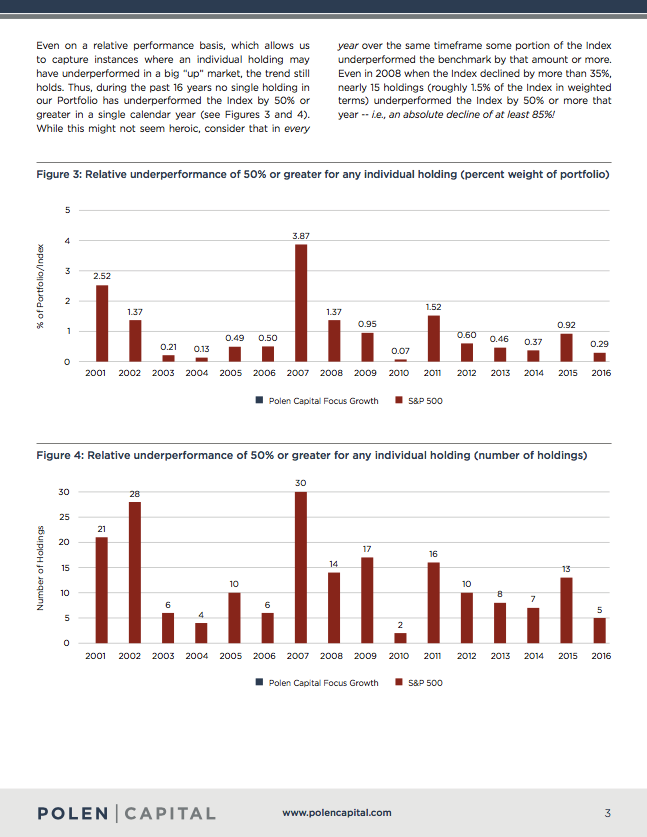

Comments